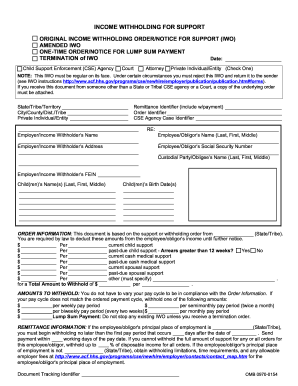

Get Income Withholding For Support

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Income Withholding for Support online

How to fill out and sign Income Withholding for Support online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Although submitting legal paperwork is typically a demanding and monotonous task, there exists a method to complete them effortlessly with the assistance of the US Legal Forms solution.

It offers you the Income Withholding for Support and navigates you through the whole process, making you feel confident about timely and accurate completion.

Complete the Income Withholding for Support on US Legal Forms even while on the move and from any device.

- Launch the document with the feature-rich online editor to start filling it out.

- Adhere to the green arrow on the left side of the page. It will provide a hint of the fields you need to complete with the inscription Fill.

- When you input the required information, the inscription on the green arrow will change to Next. If you click on it, it will lead you to the subsequent fillable field. This will ensure that you don’t overlook any fields.

- Affix your signature using the e-signing tool. Draw, type, or scan your signature, whatever works best for you.

- Press Date to insert the current date on the Income Withholding for Support. This will be done automatically.

- Optionally review the recommendations and tips to confirm that you haven’t overlooked anything and double-check the format.

- Once you have completed the form, click Done.

- Download the document to your device.

How to Modify Get Income Withholding for Support: Personalize Forms Online

Experience the convenience of a multifunctional online editor while filling out your Get Income Withholding for Support. Utilize the various tools to swiftly complete the fields and provide the necessary information immediately.

Preparing documents can be lengthy and costly unless you have pre-made editable templates to fill out digitally. The most effective method to handle the Get Income Withholding for Support is to utilize our advanced and versatile online editing solutions. We equip you with all the vital tools for quick document completion and allow you to make any modifications to your forms, tailoring them to any requirements. Furthermore, you have the option to comment on the alterations and leave notes for other participants.

Here’s what you can accomplish with your Get Income Withholding for Support in our editor:

Working with Get Income Withholding for Support in our robust online editor is the quickest and most effective way to manage, submit, and share your paperwork as you need it from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-connected device. All forms you create or fill out are securely stored in the cloud, so you can always retrieve them whenever necessary and be certain of not losing them. Stop wasting time on manual document completion and eliminate paper; do everything online with minimal effort.

- Complete the blank sections using Text, Cross, Check, Initials, Date, and Signature options.

- Emphasize important information using a preferred color or underline it.

- Conceal private details with the Blackout tool or delete them.

- Insert images to illustrate your Get Income Withholding for Support.

- Replace the original text with language that fits your needs.

- Add remarks or sticky notes to notify others about the updates.

- Remove unnecessary fillable sections and assign them to specific recipients.

- Secure the document with watermarks, dates, and bates numbers.

- Distribute the documentation in various ways and save it on your device or in the cloud in different formats after you finish editing.

To deduct child support from payroll in QuickBooks, you first need to create a new payroll item for the child support deduction. Enter the details from the income withholding order, including the amount to be withheld. Then, assign this payroll item to the employee’s profile and verify that the deductions are correctly reflected in the employee’s paycheck. For further help, resources like uslegalforms can provide templates and guidance for setting up payroll deductions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.