Loading

Get M1wfc 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M1wfc 2010 Form online

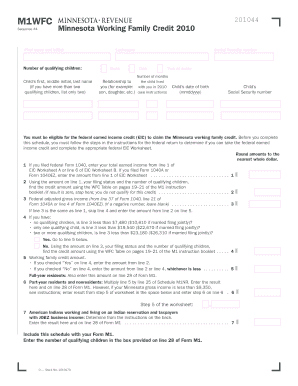

The M1wfc 2010 Form is essential for Minnesota residents who are eligible for the working family credit. This guide provides a step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to complete the M1wfc 2010 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your first name and initial followed by your last name as it appears on your official documents.

- Indicate the number of qualifying children by checking the appropriate box: 'None', 'One', or 'Two or more'.

- For each qualifying child, provide the child’s full name, relationship to you, date of birth in the format (mmddyyyy), and the child’s Social Security number.

- Complete line 1 by entering your total earned income from the specified EIC Worksheet, ensuring amounts are rounded to the nearest dollar.

- Using your amount from line 1, filing status, and the number of qualifying children, find the credit amount from the WFC Table as indicated in the instructions.

- Proceed to line 3 and enter your federal adjusted gross income, following the prompts regarding negative numbers.

- On line 4, check whether your conditions regarding the number of qualifying children and income thresholds are met, and follow the prompts to complete lines 5 and 6.

- If applicable, enter data on line 7 as instructed for specific conditions related to American Indians and JOBZ business income.

- Finally, review all entries for accuracy before saving your changes. You can download, print, or share the completed form as necessary.

Complete the M1wfc 2010 Form online today and ensure you receive any credits you may qualify for.

When filling in for tax residency, you need to provide details such as your country of residence, the type of income you earn, and any relevant identification numbers. It’s crucial to be precise to align with tax laws and requirements. Using the M1wfc 2010 Form can enhance this process by offering the necessary framework to maintain accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.