Loading

Get Form P-1 1999-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form P-1 online

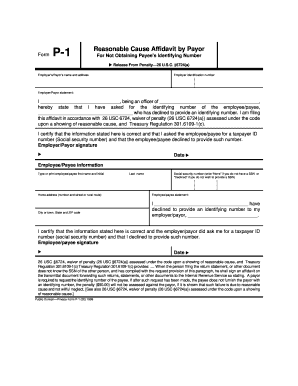

The Form P-1 serves as a reasonable cause affidavit by the payor for not obtaining the payee's identifying number. This guide provides clear, step-by-step instructions to help users complete the form online accurately and efficiently.

Follow the steps to fill out the Form P-1 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the employer's or payor's name and address in the designated fields.

- Enter the employer identification number (EIN) to identify your business.

- Complete the employer/payor statement section by typing your name as the officer and the name of your organization. Ensure accuracy when stating that you have requested the employee/payee's identifying number.

- Provide the employee/payee’s full name and home address in the appropriate fields. Include the city or town, state, and ZIP code.

- Specify the employee/payee's last name, and if they do not have a Social Security Number (SSN), write ‘None’. If the employee/payee declines to provide their SSN, indicate ‘Declined’.

- Have the employee/payee complete their statement, affirming their choice to decline providing an identifying number, along with their signature.

- Include the dates for both the employer/payor and the employee/payee after their respective signatures.

- Review all information for accuracy and completeness.

- Once complete, save your changes, and choose to download, print, or share the Form P-1 as needed.

Begin completing the Form P-1 online today for a smooth and efficient filing process.

Related links form

The P 1 form, or Form P-1, serves various purposes within tax submissions or requests. This form collects essential information necessary for the IRS to process certain claims effectively. It’s important to be precise when filling out the P 1 form to avoid processing delays. For optimal completion, consider exploring the supports offered by USLegalForms to guide you through the documentation process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.