Get 501 C 8

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 501 C 8 online

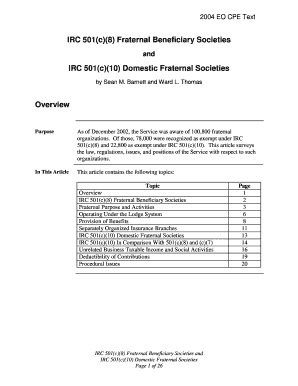

The 501 C 8 form is essential for fraternal beneficiary societies seeking tax-exempt status under the Internal Revenue Code. This guide will provide comprehensive and clear instructions on how to fill out this form online, ensuring users can navigate the process effectively, whether they have prior legal experience or not.

Follow the steps to complete the 501 C 8 form online

- Press the ‘Get Form’ button to access the 501 C 8 form and open it in your preferred online editor.

- Begin by providing the organization's name and address. Ensure all information is accurate to avoid delays in processing.

- Describe the purpose of the organization. Clearly indicate how it meets the requirements of a fraternal beneficiary society under IRC 501(c)(8). This includes details about its fraternal activities and member benefits.

- In the section regarding the lodge system, indicate whether the organization operates under such a system. Provide details about local lodges or chapters, including their oversight by a parent organization.

- State the types of benefits provided to members, such as life, sick, and accident benefits. Ensure a clear connection to how these benefits serve the organization's purpose.

- If applicable, detail any separately organized insurance branches that operate for the exclusive benefit of the members.

- Review all filled sections for accuracy and completeness. Correct any errors before finalizing the form.

- After completing the form, save your changes and consider downloading or printing a copy for your records before submitting.

Complete the 501 C 8 form online to secure your organization's tax-exempt status.

A 501 refers to a section of the Internal Revenue Code that provides tax exemptions for nonprofit organizations. Specifically, a 501c3 organization is one that operates for charitable purposes and meets IRS requirements. This classification allows you to accept tax-deductible donations, benefiting both your organization and its supporters. If you're aiming for 501 C 8 status, it's critical to follow established guidelines, and US Legal Forms can assist you in this journey.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.