Get Form 5405

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5405 online

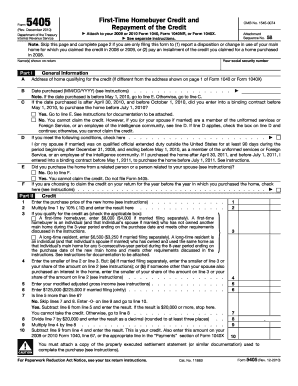

Filling out Form 5405 can seem daunting, but with a clear understanding of its components, the process becomes manageable. This guide will provide you with step-by-step instructions to successfully complete the form online, ensuring you maximize your benefits as a first-time homebuyer or long-time resident.

Follow the steps to complete Form 5405 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, where you will provide general information. Input your social security number and the names shown on your tax return. If the address of the qualifying home is different from the address on your return, enter it in section A.

- Next, enter the date you purchased the home in section B. Make sure to format this as MM/DD/YYYY. Depending on this date, follow the instructions to determine if you qualify for the credit.

- In section C, answer whether you entered into a binding contract to purchase the home before May 1, 2010. If you do not meet the criteria, review the specific notes regarding members of the uniformed services or employees of the intelligence community.

- Proceed to section D to check if you meet any special conditions for claiming the credit, particularly if you are affiliated with government service.

- In sections E and F, answer questions regarding the relatedness of the seller. Make sure to identify if you purchased from a related person, as this affects your eligibility for the credit.

- Move to Part II, beginning with line 1. Enter the purchase price of your new home and then multiply this by 10% to complete line 2.

- Identify your classification as a first-time homebuyer or a long-time resident on line 3, and enter the appropriate amounts based on the definitions provided in the instructions.

- Calculate the smaller of lines 2 or 3 and complete line 4. If applicable, insert your modified adjusted gross income on line 5 and assess its relation to line 6.

- Follow the instructions for lines 7 through 10 to determine your credit amount, making sure to attach the required documentation for your new home purchase.

- If you are filing for changes in home use or reporting dispositions, skip to Part III or IV as necessary and complete the required lines appropriately.

- Once all sections are filled out accurately, review your entries, save your changes, and proceed to download, print, or share the completed Form 5405 as needed.

Start filling out your Form 5405 online today to take advantage of your homebuyer credit.

The tax credit for homebuyers in 2008, often referred to as the first-time homebuyer credit, allowed eligible buyers to claim up to $7,500 using Form 5405. This credit aimed to stimulate the housing market by providing financial incentives for first-time buyers. If you purchased a home during that year, be sure to explore if you qualify for this credit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.