Loading

Get Md Form 505

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Md Form 505 online

Filling out the Md Form 505 online can be a straightforward process if you follow the correct steps. This guide will provide you with detailed instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete your Md Form 505 online.

- Press the ‘Get Form’ button to obtain the Md Form 505 and open it in the editor.

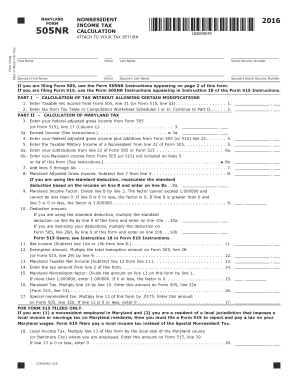

- Start by entering your first name, middle initial (if applicable), and last name in the designated fields. Follow this by inputting your Social Security number.

- If applicable, fill in your partner’s first name, middle initial, last name, and Social Security number. Ensure all names match official documents.

- In Part II, start with line 3 by entering your federal adjusted gross income from Form 505, line 17. For line 3a, if you are claiming a federal earned income credit, enter the earned income that applies.

- Continue filling in lines by following the form’s instructions, ensuring that all additions, subtractions, and calculations are performed correctly based on the provided guidelines.

- Once you reach the end, review all your entries. After confirming that everything is correct, you can save changes, download, print, or share the completed Md Form 505.

Start filling out your Md Form 505 online today for a hassle-free tax experience.

To avoid Maryland non-resident tax on real estate, ensure that you understand the residency rules and tax obligations before purchasing. You may need to establish residency or utilize exemptions if applicable. For detailed strategies and steps tailored to your situation, uslegalforms can be a valuable resource to help navigate the complexities of Maryland tax law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.