Loading

Get Ct 400

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 400 online

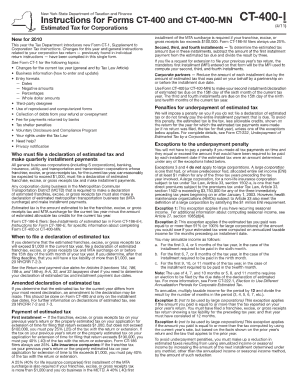

The Ct 400 is an essential form for individuals seeking to manage their tax obligations effectively. This guide provides step-by-step instructions to help users fill out the form online with confidence.

Follow the steps to complete your Ct 400 online

- Press the ‘Get Form’ button to access the Ct 400 and launch it in your preferred digital editor.

- Provide your personal information, including your full name, address, and Social Security number. Ensure that all entered details match official documents to avoid processing delays.

- Complete the income section by accurately reporting all sources of income. Include wages, self-employment earnings, and any other relevant financial information.

- Fill in the deductions and credits section. Keep documentation handy to accurately reflect any deductions or credits you may qualify for, as this will help reduce your tax liability.

- Review the tax calculation fields. The form will automatically compute your tax obligations based on the information you provided. Thoroughly check these calculations for accuracy.

- Finalize the form by signing and dating it electronically. This step confirms your consent to the information submitted.

- After confirming that all fields are correctly filled, choose to save your changes, download a copy, or print the form for your records. You may also share it if needed.

Take control of your tax filing — complete your Ct 400 online today.

To file a Connecticut annual report online, access the Connecticut Secretary of State's website and provide the required information about your business. This process ensures that you stay compliant and maintain good standing in the state. Using our platform can simplify finding the necessary forms and walking you through the filing steps efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.