Get Financial Guarantee Bond Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Financial Guarantee Bond Form online

Filling out the Financial Guarantee Bond Form online is a straightforward process that ensures compliance with financial assurance requirements for solid waste management facilities. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the Financial Guarantee Bond Form online.

- Click the ‘Get Form’ button to obtain the Financial Guarantee Bond Form and open it in your editor.

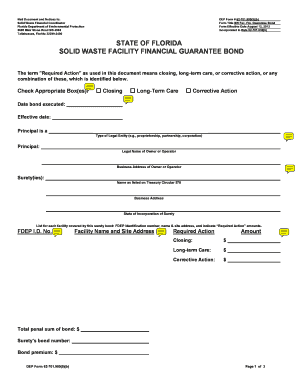

- In the section labeled 'Required Action,' check the appropriate box(es) that apply to your situation—'Closing,' 'Long-Term Care,' or 'Corrective Action.'

- Fill in the 'Date bond executed' and 'Effective date' fields. Ensure these dates reflect the accurate timeline for your bond.

- Identify the Principal by completing the 'Type of Legal Entity' field, such as proprietorship, partnership, or corporation. Next, enter the 'Legal Name of Owner or Operator' and their 'Business Address.'

- In the 'Surety(ies)' section, write the name as listed on Treasury Circular 570, the 'Business Address,' and the 'State of Incorporation of Surety.'

- For each facility covered by this surety bond, list the FDEP identification number, 'Facility Name and Site Address,' and indicate the 'Required Action' amounts for Closing, Long-Term Care, and Corrective Action.

- Calculate the 'Total penal sum of bond' and the 'Bond premium,' entering these figures in their respective fields.

- In the section 'Know All Persons By These Presents,' ensure that the necessary authorization signatures are filled in by the Principal and Surety(ies). This includes the signature of the Authorized Representative of Principal, their name, title, and contact information.

- If applicable, include the required information for each Surety (co-surety), attaching additional pages if necessary.

- Review all entries for accuracy and completeness before finalizing.

- Once completed, save the changes, and choose to download, print, or share the form as appropriate.

Begin completing your Financial Guarantee Bond Form online today to ensure compliance with environmental regulations.

Filling out a bond form involves several straightforward steps. First, gather the necessary information such as the names of the parties involved and the specific obligations under the bond. Next, carefully complete the Financial Guarantee Bond Form, ensuring all details are accurate and clearly stated. Lastly, review the completed form for any errors before submitting it to ensure the process moves forward without delays.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.