Loading

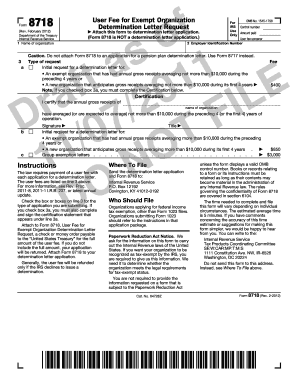

Get Form 8718 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8718 2012 online

Filling out Form 8718 is an essential step for organizations applying for an exempt organization determination letter. This guide will provide you with clear instructions on how to complete this form efficiently online.

Follow the steps to fill out Form 8718 with ease.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first section, enter the name of your organization in the designated field. Ensure accuracy as this information is critical for your application.

- Provide the Employer Identification Number (EIN) for your organization. This number is essential for the IRS to identify your organization.

- Specify the type of user fee request by checking the appropriate box in section 3. Ensure that you understand the user fee applicable to your organization based on its gross receipts.

- If applicable, complete the certification statement below section 3a, certifying that the annual gross receipts of your organization do not exceed $10,000. This step is mandatory if you check box 3a.

- Sign and enter your title in the provided fields to authenticate the form.

- Attach a check or money order made payable to the 'United States Treasury' for the user fee amount, and ensure it is included with your application.

- Once all sections are completed, saving changes is essential. You may also download, print, or share the form as required.

Start completing your Form 8718 online today to ensure your application for exempt organization status is submitted accurately.

Form 8288 is a tax form that non-resident aliens use to report and remit tax on the sale of U.S. real property. Submit this form along with the appropriate payment to the IRS. If you're uncertain about your filing requirements or how it may interact with other forms like Form 8718 2012, consider consulting uslegalforms for comprehensive assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.