Get Cook County Assessors Office Class 6b Eligibility Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cook County Assessors Office Class 6b Eligibility Application Form online

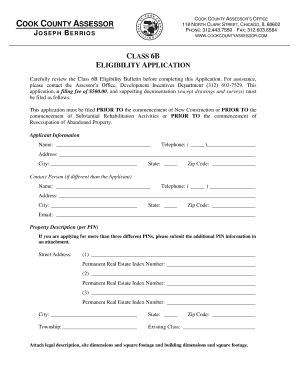

The Cook County Assessors Office Class 6b Eligibility Application Form is a key document for property owners seeking incentives for certain property developments. This guide provides a detailed, step-by-step process to help users navigate the online form effectively.

Follow the steps to complete the application with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This action will allow you to access the Class 6b Eligibility Application Form for completion.

- Begin filling out the applicant information section. Provide your name, telephone number, and address. If someone other than you will be the main contact, fill in their information in the contact person section.

- For the property description section, enter the street address and the Permanent Real Estate Index Number (PIN) for up to three properties. Ensure accuracy, as this information is critical for the application.

- In the identification of persons having an interest in the property, attach a complete list of all owners, developers, and any other parties with interest, detailing their names, addresses, and the nature of their interest.

- Next, you will need to provide a detailed description of the intended industrial use for the property. If multiple uses are planned, include the relative percentages for each use.

- Indicate the nature of the proposed development by checking the appropriate box, whether it is new construction, substantial rehabilitation, or the occupation of abandoned property. Follow the corresponding instructions and complete the necessary sections based on your selection.

- If your application includes new construction or substantial rehabilitation, provide the estimated dates of construction commencement and completion. Attach required planning documents and a detailed cost description.

- For reoccupation of abandoned property, answer the questions regarding the vacancy duration and list all relevant details about the previous occupancy and sale.

- If applicable, complete the TEERM Supplemental Application with the necessary documentation if you are eligible based on special circumstances.

- Do not forget to include the local approval section, attaching a certified resolution or ordinance from the municipality supporting your application.

- After ensuring all sections of the form are filled out correctly and all attachments included, review the application for accuracy. Save changes, then either download, print, or share the completed form as needed.

Begin the application process online to take advantage of the Class 6b incentives.

The senior exemption offered by the Cook County Assessor's Office provides financial relief to eligible older adults, resulting in a reduction of their property taxes. Seniors must be at least 65 years old and meet specific income requirements to qualify for this exemption. By submitting the Cook County Assessors Office Class 6b Eligibility Application Form, seniors can ensure they benefit from these savings. This exemption not only helps seniors maintain their homes but also promotes community stability.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.