Loading

Get Irs Form 2210 For 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 2210 for 2012 online

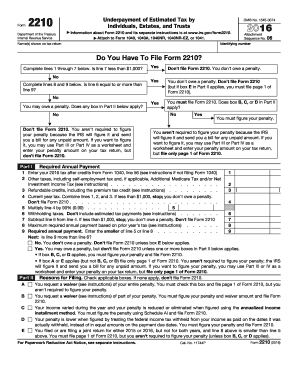

Filling out the IRS Form 2210 for 2012 can seem daunting, but this guide offers clear and supportive instructions to help you complete the form accurately. This document is essential for determining if you owe a penalty for underpayment of estimated taxes.

Follow the steps to fill out the IRS Form 2210 for 2012 online.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Enter the names shown on your tax return at the top of the form.

- Provide your identifying number. This is usually your Social Security number or Employer Identification Number.

- Review the questions regarding whether you need to file Form 2210. Complete lines 1 through 7. If line 7 is less than $1,000, you generally do not need to file the form.

- If applicable, complete lines 8 and 9 to fill in your required annual payment and check if you owe a penalty.

- If you determine that you may owe a penalty, check the applicable boxes in Part II regarding your reasons for filing the form.

- Proceed to Part III or Part IV to calculate your penalty using either the short method or regular method based on your specific situation.

- Fill in each relevant section of the form according to your calculations. Ensure you enter all applicable amounts in the appropriate lines.

- Once you have completed the form, review all entries for accuracy.

- Finally, save your changes, download for your records, and print or share the form according to your needs.

Complete your IRS Form 2210 online today to ensure accurate tax filings.

Yes, TurboTax does offer the option to file IRS Form 2210 for 2012. This feature allows users to efficiently calculate their underpayment penalty and ensures compliance with IRS guidelines. By using TurboTax, you can streamline your tax preparation process, making it easier to file required forms and avoid any penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.