Loading

Get Form 8453 Pe

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8453 Pe online

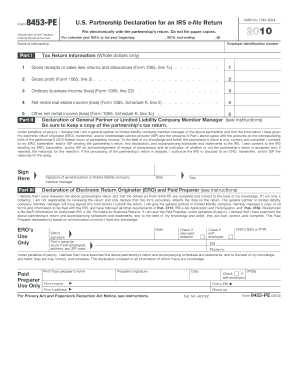

Filing the Form 8453 Pe is an essential step for partnerships submitting their tax returns electronically. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Form 8453 Pe online.

- Click the ‘Get Form’ button to access the Form 8453 Pe and open it for editing.

- Enter the partnership's name in the designated field. Make sure to print or type clearly.

- Input the partnership's employer identification number (EIN) in the space provided.

- Provide the required financial information in Part I, including gross receipts or sales, gross profit, ordinary business income or loss, net rental income or loss, and other net rental income or loss, as applicable.

- In Part II, the general partner or limited liability company member manager must declare the accuracy of the information provided. They will need to sign and date the form.

- If applicable, Part III must be filled out by the electronic return originator (ERO) or paid preparer, including their signature and PTIN, ensuring all relevant boxes are checked.

Complete your Form 8453 Pe online today to ensure timely filing of your partnership's tax return.

You cannot file Form 8453 PE online; it must be mailed to the IRS after you process your electronic tax return. The IRS requires this form in paper format as part of their verification process. To ensure you handle this correctly, consider using US Legal Forms, which guides you through filing procedures, ensuring all requirements are met expertly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.