Get Irs Form 6252 201

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 6252 201 online

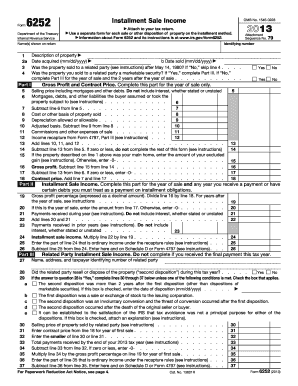

This guide provides a comprehensive overview of how to accurately complete the IRS Form 6252, which is used to report income from installment sales. Whether you are an experienced taxpayer or new to this process, this step-by-step guide will help you understand each section and field of the form.

Follow the steps to complete the IRS Form 6252 efficiently.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Provide your identifying information, including your name and taxpayer identification number, as indicated on the form.

- In Part I, report details about the property you sold. Include the description of property, date acquired, and date sold. If the property was sold to a related party or if there were special considerations, answer accordingly.

- Complete lines 5 through 12 to report your gross profit and contract price. Carefully subtract and add values as instructed, ensuring accuracy in your calculations.

- In Part II, indicate your installment sale income by completing the corresponding lines, ensuring to specify payments received during the year and those received in prior years.

- If applicable, fill out Part III for related party installment sale income. Answer all relevant questions regarding the resale or disposition of the property by the related party.

- Review the completed form for accuracy. Make sure all required fields are filled out and calculations are correct.

- Once satisfied with the form, save your changes, download a copy for your records, and print if necessary. You may also share the completed form as needed.

Begin filling out the IRS Form 6252 online today to ensure accurate reporting of your installment sales.

You should use IRS Form 6252 when you sell property and receive at least one payment after the tax year of the sale. This includes sales of real property, personal property, and even some business assets. If your sale qualifies under the installment sale rules, it's crucial to file this form. Proper utilization of Form 6252 ensures you comply with IRS regulations while managing your tax obligations effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.