Get Form 5884

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5884 online

Filling out the Form 5884-B online can seem daunting, but this guide will provide you with clear, step-by-step instructions to help you complete the new hire retention credit application efficiently. Whether you have experience with tax forms or not, you will find this guide accessible and easy to follow.

Follow the steps to complete the Form 5884 effectively

- Click 'Get Form' button to obtain the form and open it for editing.

- Begin by entering the name(s) shown on your tax return at the top of the form. This ensures that the IRS correctly identifies your submission.

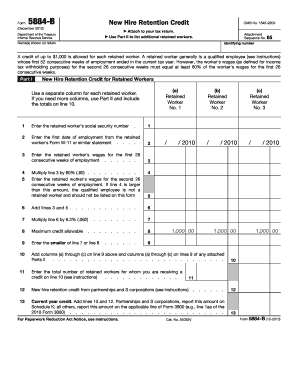

- In Part I, list each retained worker in separate columns, starting with their social security number. Ensure you include all required workers to maximize your credit claim.

- Record the first date of employment for each worker by referring to their Form W-11 or similar statement.

- Input the retained worker's wages for the first 26 consecutive weeks of employment in the designated section.

- Multiply the amount on line 3 by 80% and enter this figure in the provided space to determine eligibility.

- Next, input the retained worker's wages for the second 26 consecutive weeks, ensuring that the previous calculation supports their retained worker status.

- Add lines 3 and 5 together, then multiply this sum by 6.2% to ascertain the eligible credit amount.

- Refer to the maximum credit allowable and enter the smaller of the calculated amount or this maximum in the specified area.

- If needed, use Part II for any additional retained workers, following the same information requirements as Part I.

- Finally, review all entered information for accuracy, then save any changes and explore options to download, print, or share your completed form as needed.

Complete your forms online efficiently and take advantage of the new hire retention credit opportunities.

Yes, if your business hires individuals from certain targeted groups, filling out the Work Opportunity Tax Credit application can lead to significant tax savings. This process can be facilitated by using Form 5884, which provides a structured approach to claiming the benefits. Be proactive in understanding the eligibility requirements to optimize your benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.