Loading

Get Uk 313293 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK 313293 online

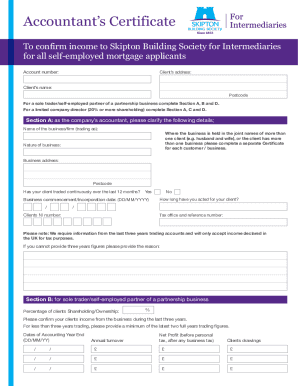

Filling out the UK 313293 form can seem daunting, but this guide will walk you through each section and field step-by-step. Whether you are a sole trader or a limited company director, this comprehensive approach will ensure you provide all necessary information clearly and accurately.

Follow the steps to effectively complete the UK 313293 form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin with entering the client's account number in the designated field.

- Fill in the client's address, including the postcode and name.

- Identify your client type: if they are a sole trader or a self-employed partner of a partnership, complete sections A, B, and D. For a limited company director with 20% or more shareholding, complete sections A, C, and D.

- In Section A, enter the name of the business or firm, the nature of the business, and its address along with the postcode. Indicate if the client has traded continuously for the past 12 months by selecting yes or no.

- Provide the business commencement or incorporation date in the format DD/MM/YYYY, and indicate for how long you have acted for your client along with their National Insurance number and tax office reference.

- In Section B, dedicated to sole traders, indicate the percentage of shareholding or ownership, followed by the client’s income details for the last three years including the accounting year end dates, annual turnover, net profit, and drawings.

- For limited company directors in Section C, provide the percentage of shareholding or ownership and fill out the financial year end dates for the latest and previous two years. Include the business’s annual turnover, profits before and after tax, total dividends, closing cash balance, total assets, total liabilities, shareholder funds, and both salary and dividends for the applicant.

- In Section D, confirm whether the figures have been finalized and provide any necessary explanations if they have not. State any qualifications to accounts and other income details.

- Finally, confirm that the figures provided are true and accurate, and include your accountancy firm name, contact information, and your signature. Ensure you also provide your qualification details.

- Once all sections are completed, you can save your changes, download, print, or share the completed form as needed.

Complete the UK 313293 form online today to ensure your mortgage application is processed smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.