Loading

Get Form 2210

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2210 online

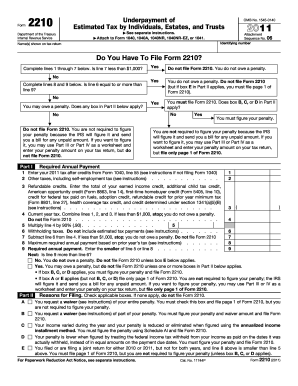

Form 2210 is used to determine if you owe a penalty for underpayment of estimated tax. This guide will walk you through each step to effectively complete the form online.

Follow the steps to fill out Form 2210 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identifying number and the name(s) shown on your tax return. This information is essential for the IRS to process your Form 2210 correctly.

- Answer the questions under the 'Do You Have To File Form 2210?' section. This includes completing lines 1 through 7 to determine if you owe a penalty or if you can skip filing the form.

- In Part I, calculate your required annual payment. Start by entering your 2011 tax after credits, other taxes, and refundable credits on the specified lines.

- Combine the values from lines 1, 2, and 3 to calculate your current year tax, then determine if this amount is less than $1,000. Follow the instructions for penalty assessment based on your answers.

- In Part II, mark any applicable boxes that explain your reasons for filing. Only check the boxes if they apply to your situation to ensure accurate processing.

- Proceed to Part III if you can use the Short Method, or go to Part IV for the Regular Method based on your payment method and any estimates made.

- Fill out the applicable lines in Parts III and IV, providing necessary calculations and ensuring all information is accurate.

- Once all sections have been completed, review for accuracy. You can save your changes, download, print, or share the completed form as needed.

Complete your Form 2210 now to ensure you meet your tax obligations.

Related links form

To avoid an IRS penalty for underpayment of taxes, ensure you make estimated tax payments that are accurate and timely throughout the year. Regularly review your income and tax obligations to adjust payments as necessary. Utilizing tools like Form 2210 can help clarify your situation and guide you on making the right choices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.