Loading

Get 8879 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8879 Form online

Filling out the 8879 Form online is an essential step for anyone who wishes to authorize their electronic tax return filing. This guide aims to provide you with clear, step-by-step instructions to ensure you complete this process smoothly and accurately.

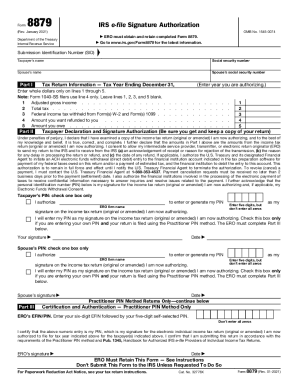

Follow the steps to complete your 8879 Form online

- Press the ‘Get Form’ button to access the 8879 Form and open it in your document editor.

- Enter the Submission Identification Number (SID) at the top of the form.

- Fill in the taxpayer’s name and social security number, followed by the spouse’s name and social security number if applicable.

- In Part I, provide the tax return information, including the adjusted gross income and total tax as whole dollars. Remember, if you are filing Form 1040-SS, leave certain lines blank as instructed.

- Continue entering the amounts from your tax return on the corresponding lines for federal income tax withheld and any amounts owed or refunded.

- In Part II, check the appropriate box to authorize the ERO to enter or generate your PIN or indicate that you will enter your own PIN.

- Sign and date the Form 8879, ensuring that you have provided a handwritten or electronic signature as permitted.

- Once completed, deliver the signed Form 8879 back to the ERO using your preferred delivery method: hand delivery, U.S. mail, private service, email, or fax.

- Finally, make sure to save your changes, and if needed, download or print a copy of the completed form for your records.

Complete your documents online clearly and confidently.

Yes, tax returns, including your 1040 Form, can serve as proof of income. They provide a comprehensive snapshot of your earnings for the year and are often required when applying for loans or financial assistance. When submitting your tax returns, be sure to include relevant forms that reflect your total income. The US Legal Forms platform can assist you in preparing and organizing your tax documentation effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.