Loading

Get Form 2848 Instructions 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2848 Instructions 2011 online

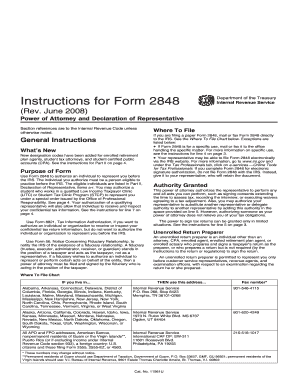

Filling out Form 2848, the Power of Attorney and Declaration of Representative, online is an essential step for those looking to authorize someone to represent them before the IRS. This guide provides clear, concise instructions to help you navigate each section and field of the form effectively.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with line 1 where you fill out taxpayer information. Enter your name, social security number, and address. If filing jointly, include your spouse’s details.

- On line 2, provide your representative’s full name and their nine-digit CAF number. Ensure the information is identical in all submissions.

- For line 3, specify the type of tax, tax form number, and relevant years or periods. Each entry must be specific; avoid general terms.

- Line 5 allows you to modify the acts that your representative can perform. Clearly indicate any permissions or restrictions here.

- On line 6, if you want your representative to receive refund checks for you, initial this section and provide their name.

- Complete lines 7 and 8 regarding notices and the retention or revocation of prior powers of attorney.

- Finally, sign and date the form in line 9. Ensure both the taxpayer and representative signatures are within 45 days of each other.

Complete your Form 2848 online to streamline your tax representation process.

Generally, Form 2848 does not require notarization. Instead, it needs signatures from both the taxpayer and the representative. To confirm this detail and follow the Form 2848 Instructions 2011 correctly, it's best to review the IRS requirements or consult legal services for assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.