Loading

Get Tx 54-103 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 54-103 online

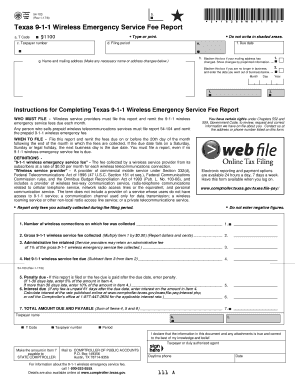

The TX 54-103 form is essential for wireless service providers in Texas to report and remit the 9-1-1 wireless emergency service fees. This guide will provide clear instructions on how to complete the form online, ensuring accurate submission.

Follow the steps to complete the TX 54-103 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your taxpayer number in the provided field. This number is unique to your business and is necessary for proper identification.

- Fill in the filing period. Specify the month and year for which you are reporting the fees collected.

- Indicate the due date for this report in the assigned field, ensuring you adhere to the submission timeline.

- Provide your name and mailing address. If your mailing address has changed, blacken the corresponding box and make the necessary changes.

- If applicable, indicate that you are no longer in business by blackening the relevant box and supplying the date you ceased operations.

- In the section regarding 9-1-1 fees collected, report the number of wireless connections on which the fee was collected during the filing period.

- Calculate the gross 9-1-1 wireless service fee collected by multiplying the number of wireless connections by $0.50 and enter that amount.

- Enter any administrative fee retained, which can be 1% of the gross 9-1-1 wireless emergency service fee collected.

- Calculate the net 9-1-1 wireless service fee due by subtracting the administrative fee from the gross collected fee.

- If the report is submitted late, calculate and enter any penalties based on how late the submission is.

- If any fees remain unpaid 61 days after the due date, calculate and report the interest due.

- Sum items to find the total amount due and payable and enter that total.

- Review all entries to ensure accuracy, then declare that the information provided is true and correct to the best of your knowledge.

- Save the completed form, and utilize the options to download, print, or share it as necessary.

Complete your TX 54-103 filing online today to ensure compliance with reporting requirements.

Every California phone bill comes with a 30-cent 911 surcharge. Thirty cents may not seem like a lot, but with every phone customer paying this fee every month for every line, the amount adds up.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.