Loading

Get Fillable Forms 1041

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Fillable Forms 1041 online

Filling out the Fillable Forms 1041 online can seem daunting, but with the right guidance, it becomes a straightforward process. This guide provides clear, step-by-step instructions to assist users in completing their form accurately and efficiently.

Follow the steps to successfully complete your Fillable Forms 1041 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

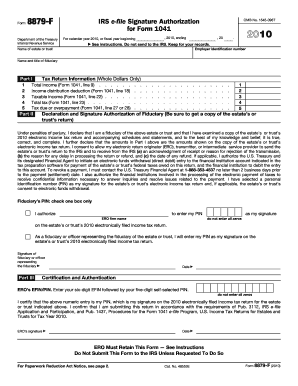

- Fill in the employer identification number at the top of the form. This number is unique to your estate or trust and is essential for processing your form correctly.

- Enter the name of the estate or trust in the designated field. Ensure that the name matches the information provided in other documents related to the estate or trust.

- In the section titled 'Part I', input the total income from Form 1041, line 9, ensuring that all amounts are expressed in whole dollars only.

- Continue filling out 'Part I' with the income distribution deduction from Form 1041, line 18, and fill in the taxable income as indicated on Form 1041, line 22.

- Next, input the total tax due or overpayment, as shown on Form 1041, line 27 or 28, ensuring accuracy to avoid discrepancies with the IRS.

- Move to 'Part II' and sign in the declaration section, confirming that all information is true and complete. This signature acts as the fiduciary's consent for the electronic filing.

- Choose whether to authorize the electronic return originator (ERO) to enter your personal identification number (PIN) or if you will enter it yourself. Make sure to select only one option.

- In 'Part III', enter the ERO’s EFIN and your PIN, confirming the accuracy of this information as your signature on the tax return.

- Finally, review all entered information for accuracy. Once you are satisfied, you can save your changes, download, print, or share the completed form as needed.

Start completing your Fillable Forms 1041 online today for a streamlined tax filing experience.

The penalty for failing to file Form 1041 on time can result in both fines and interest charges on any unpaid tax liability. The penalties increase the longer the form is left unfiled. Choosing to utilize fillable Forms 1041 from US Legal Forms helps ensure your filing is timely and accurate, reducing the risk of incurring penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.