Loading

Get Form 8300 Process

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8300 Process online

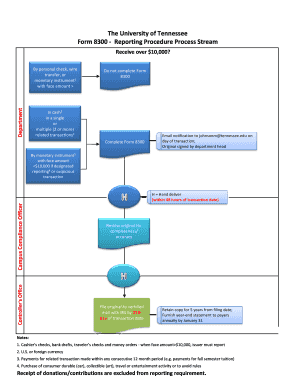

Filing the Form 8300 is an essential process for reporting cash transactions over $10,000. This guide provides a detailed, step-by-step approach to filling out the Form 8300 online, ensuring that you meet all requirements accurately and efficiently.

Follow the steps to complete the Form 8300 Process online

- Press ‘Get Form’ button to access the form and open it in the designated editor.

- Identify the transaction type. If you are receiving cash, whether in a single or multiple related transactions exceeding $10,000, ensure you select the appropriate option to complete Form 8300. For transactions by personal check, wire transfer, or monetary instruments below $10,000, note that Form 8300 does not need to be completed.

- Fill out the required fields on the form. This includes providing details about the receiving department, the transaction date, the amount of cash received, and identifying information of the person or entity providing the cash.

- Ensure to include email notification to the responsible office or individual on the day of the transaction as specified, including the proper order of signatures if required.

- Review the form for accuracy and completeness before finalizing your submission. This is crucial to prevent any delays or issues with the IRS.

- Once the form is complete, retain a copy for your records for a minimum of five years from the filing date. Additionally, prepare to furnish year-end statements to the payers by January 31 of the following year.

- Save the changes made to the form. You can choose to download, print, or share the completed Form 8300 as necessary.

Complete your Form 8300 filings online today for seamless compliance.

To properly fill out a tax withholding form, determine your filing status and the number of allowances you are eligible to claim. Ensure you provide correct personal information to avoid mistakes. Resources like US Legal Forms also offer templates for tax forms, helping you calculate withholding accurately. Mastering the Form 8300 Process contributes to your overall tax compliance and management.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.