Loading

Get Tcc001 Sars Live Copy Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tcc001 Sars Live Copy Form online

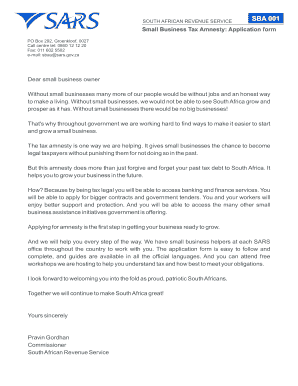

The Tcc001 Sars Live Copy Form is an essential document for individuals and businesses seeking to apply for tax amnesty in South Africa. This guide provides comprehensive steps to help users complete the form easily and effectively, ensuring all necessary information is accurately submitted for consideration.

Follow the steps to fill out the Tcc001 Sars Live Copy Form online.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Begin by completing section 1a if applying as an individual or deceased/insolvent estate. Provide your surname, first names, date of birth, and other identification details.

- If applying as a trust, close corporation, or unlisted company, fill out section 1b with the registered name, trade name, registration number, and relevant addresses.

- In section 1c, enter contact numbers including work, home, fax, cellphone, and email address.

- Section 1d requires you to provide the particulars of your bank account, including the name of the account holder, account number, type of account, and the name of the bank.

- Proceed to section 2 to provide the particulars of the public officer, representative, or trustee, including initials, surname, date of appointment, postal address, business address, and contact numbers.

- In section 3, select the category of application you are submitting by marking the appropriate option.

- Move to section 4 and mark the applicable taxes for which you are applying for amnesty.

- Provide your tax reference numbers in section 5 for income tax, VAT, PAYE, UIF, and SDL.

- Detail your business information in section 6, including gross income and nature of the business.

- Complete section 7 with financial information regarding the taxable income for the 2006 year of assessment.

- Declare if any amounts in the attached documents are estimated and provide a summary if necessary.

- In section 8, refer to the applicable rates for calculating the tax amnesty levy and input your taxable income.

- Provide your declaration and signature at the end of the form, confirming all information is true and correct.

- Finally, users can save changes, download a copy, print, or share the completed form as needed.

Complete your Tcc001 Sars Live Copy Form online today to take advantage of the tax amnesty program!

Related links form

TCS, or Tax Compliance Status, relates to your standing with SARS. It indicates whether you are compliant with tax regulations. Understanding your TCS can help you complete forms like the Tcc001 Sars Live Copy Form, ensuring you maintain good standing with tax authorities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.