Loading

Get Irs Form 5695 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 5695 online

IRS Form 5695 is essential for individuals seeking residential energy credits for energy-efficient property improvements. This guide will provide clear steps to help you successfully complete the form online.

Follow the steps to fill out IRS Form 5695 accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

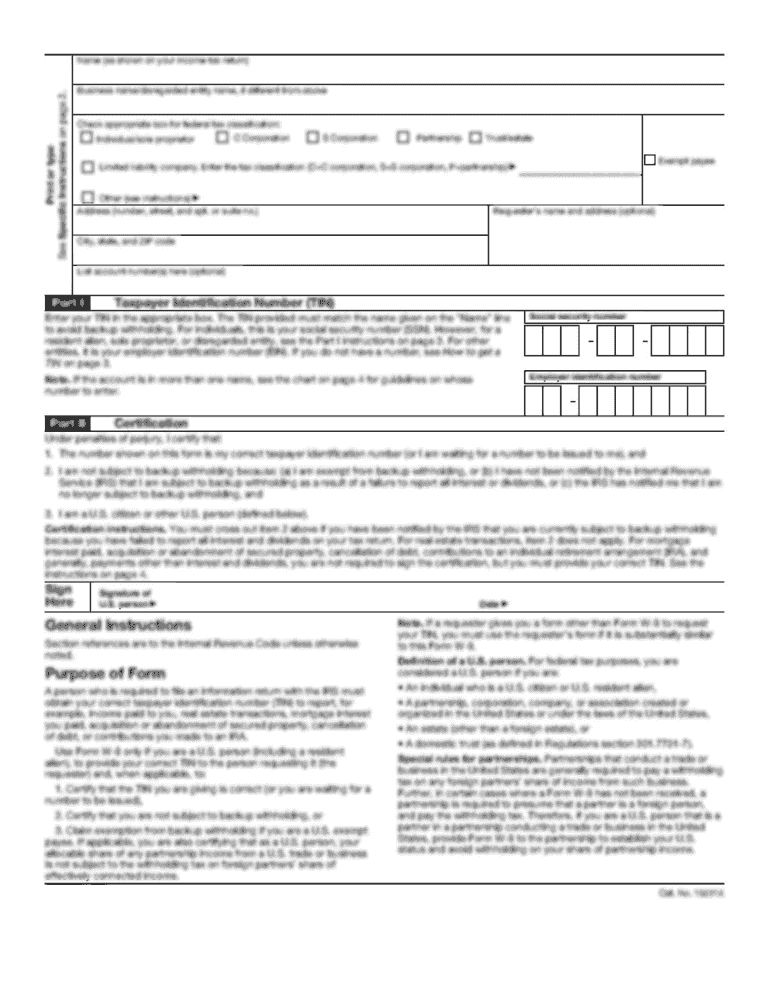

- Begin by entering your social security number and the name(s) displayed on your tax return at the top of the form.

- Proceed to Part I for the Residential Energy Efficient Property Credit. Here, enter your qualified solar electric property costs on line 1.

- Next, record the qualified solar water heating property costs on line 2, the qualified small wind energy property costs on line 3, and the qualified geothermal heat pump property costs on line 4.

- Add lines 1 through 4 together and enter the total on line 5.

- Multiply line 5 by 30% and enter the result on line 6.

- For qualified fuel cell property, answer 'Yes' or 'No' to indicate if it was installed at your main home. If 'No', skip to line 12.

- If you answered 'Yes', print the complete address of your main home where the fuel cell property was installed on line 7b and enter the qualified fuel cell property costs on line 8.

- Multiply the costs on line 8 by 30% and record this on line 9.

- Provide the kilowatt capacity of the property in line 10 and the smaller of line 9 or line 10 on line 11.

- Enter any credit carryforward from 2018 on line 12 and add it to lines 6, 11, and 12 to find the total on line 13.

- Complete line 14 by entering the amount from the Residential Energy Efficient Property Credit Limit Worksheet.

- Record the final residential energy efficient property credit on line 15, entering the smaller value of line 13 or line 14. This amount should also be included on your relevant tax schedule.

- Complete Part II for the Nonbusiness Energy Property Credit if applicable. Answer the initial questions regarding your main home and provide the necessary details.

- Follow through the lines for qualified energy efficiency improvements and residential energy property costs as instructed, calculating totals as required.

- Once all sections are filled out accurately, save your progress, download the completed form, print it for your records, or share it if necessary.

Complete IRS Form 5695 online and take advantage of available energy credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To claim the credit, you'll need IRS Form 5695. Work out the credit amount on that form then enter it on your 1040. You should keep your receipt for the appliance as well as the Manufacturer's Certification Statement, so you can prove your claim if the IRS ever conducts an audit.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.