Get Appealing Franklin County Board Of Revision Decision Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Appealing Franklin County Board Of Revision Decision Form online

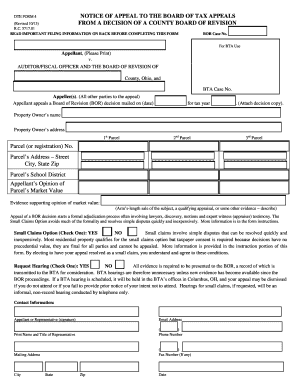

Completing the Appealing Franklin County Board Of Revision Decision Form is an essential step in challenging a decision regarding property valuation. This guide provides clear, step-by-step instructions for filling out the form correctly, ensuring a smoother appeal process.

Follow the steps to fill out the form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide the Board of Revision case number in the designated field.

- Enter your name as the appellant in the section labeled ‘Appellant, (Please Print)’.

- List the names of all appellees in the section provided, including the county auditor and others involved in the appeal.

- Indicate the date the Board of Revision mailed their decision and the tax year in question.

- Enter the property owner's name and address in the specified fields.

- Fill in parcel details, including parcel numbers and addresses for each parcel being appealed.

- State your opinion on the market value of the property in the corresponding section.

- Provide evidence supporting your opinion of market value, such as details of a recent sale or appraisal.

- Select whether you wish to opt for the Small Claims Option by checking ‘YES’ or ‘NO’.

- Indicate whether you are requesting a hearing by checking ‘YES’ or ‘NO’.

- Complete your contact information, including email address, phone number, and mailing address.

- Sign the form in the designated area and enter the date of signing.

- Review all entered information for accuracy, then save changes, download, or print the form for submission.

Complete your appeal form online to ensure a timely review of your case.

Filing an appeal with the Cook County Board of Review involves preparing your case by collecting documentation that supports your position on the property assessment. After that, complete the required appeal form, which you can find on the Board's website. Utilizing tools such as USLegalForms helps streamline this process, ensuring all information is accurately submitted. Keep the Appealing Franklin County Board Of Revision Decision Form in mind for similar appeals across different counties.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.