Loading

Get Form St-809 New York State And Local Sales And Use Tax ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

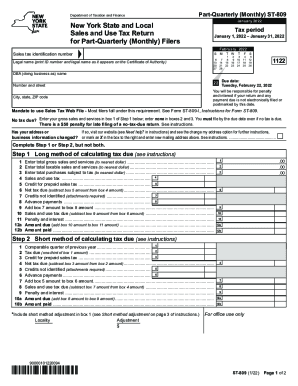

How to fill out the Form ST-809 New York State and Local Sales and Use Tax online

Filling out the Form ST-809 for New York State and Local Sales and Use Tax can be straightforward when you have the right guidance. This user-friendly guide will provide you with step-by-step instructions on how to complete the form accurately.

Follow the steps to complete the Form ST-809 with ease.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Enter your sales tax identification number in the designated field at the top of the form to ensure proper identification.

- Provide your legal name as it appears on your Certificate of Authority. Ensure that the name is printed clearly and accurately.

- If applicable, fill in your DBA (doing business as) name. This helps in identifying the business you operate under.

- Indicate if there have been any changes to your address or business information. Use the provided box to mark it as necessary.

- Proceed to Step 1 or Step 2 for calculating tax due. Choose one method only. If you use Step 1, provide total gross sales and taxable sales as specified.

- In Step 1, fill in boxes 1 through 12, ensuring to calculate any credits for prepaid sales tax and penalties accurately.

- If you choose Step 2, follow the instructions to fill in the corresponding boxes related to the previously comparable quarter's tax due.

- After completing either Step 1 or Step 2, make sure to review the totals calculated and confirm the amounts are correct.

- Finally, sign the form in the designated area, ensuring all required fields are complete before submission.

- Save your changes, and download or print the completed form for your records.

- If needed, share the form appropriately for further processing.

Start filling out Form ST-809 online today to ensure timely processing of your sales and use tax.

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.