Get Irs Form 2841

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 2841 online

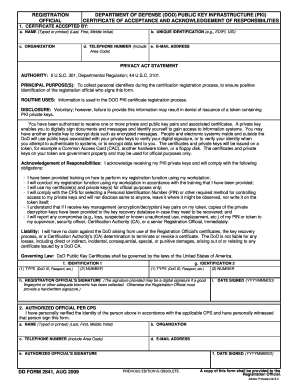

Filling out the IRS Form 2841, which is essential for certifying acceptance of responsibilities within the Department of Defense Public Key Infrastructure, can be straightforward when guided effectively. This guide provides clear, step-by-step instructions to assist users in completing the form online.

Follow the steps to successfully complete the IRS Form 2841 online.

- Click the ‘Get Form’ button to access the IRS Form 2841. This will open the form in an editable format, allowing you to input your information.

- Begin filling out section 1 by entering the name of the person accepting the certificate in the format (Last, First, Middle Initial). Provide their unique identification, such as EDIPI or UID, organization name, email address, and telephone number including area code.

- Read and understand the privacy act statement. This section outlines the authority, principal purposes, routine uses, and disclosure for the data you provide. It is essential to acknowledge the voluntary nature of this information.

- In the acknowledgment of responsibilities section, confirm your understanding of the obligations associated with receiving a PKI private key. Make sure to detail training received and compliance with procedures outlined.

- Provide information for identification, including types and numbers for two different forms of ID, such as a DoD ID or Passport.

- Sign the form digitally, if a biometric has been collected, or provide a handwritten signature indicating the registration official's approval.

- Indicate the date of signing in the YYYYMMMDD format.

- For the authorized official section, fill in their name, organization, telephone number, and email address, and ensure they provide their signature and signing date.

- Once all sections are completed, review the information for accuracy. After ensuring everything is correct, you can save your changes, download, print, or share the completed form as necessary.

Complete your IRS Form 2841 online effortlessly using these steps.

To fill out a form for a stimulus check, first gather your financial documents, such as your tax returns and bank details. Complete the corresponding IRS form that applies to your situation while ensuring all entered information is correct. Submitting your completed form promptly is crucial to receive your funds. Leverage tools from US Legal Forms to facilitate accurate and efficient completion.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.