Loading

Get Form Met 1 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Met 1 Fillable online

Filling out the Form Met 1 Fillable online requires careful attention to detail and a clear understanding of its components. This guide provides comprehensive instructions to ensure you can accurately complete the form for payment deferral of Maryland estate tax related to qualified agricultural property.

Follow the steps to fill out the Form Met 1 Fillable online effectively.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

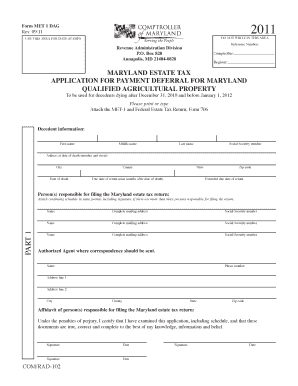

- Begin by providing the decedent's information, including their first name, middle name, last name, Social Security number, address at the date of death, city, county, state, and zip code. Ensure accuracy as this information is critical.

- Under the section for the person(s) responsible for filing the Maryland estate tax return, list their names, complete mailing addresses, and Social Security numbers. If there are more than three responsible persons, attach a schedule with the same format and signatures.

- Designate an authorized agent for correspondence regarding the filing. This includes their name, address, city, phone number, county, state, and zip code.

- In the affidavit section, ensure that all responsible persons sign and date the document, certifying the accuracy of the application.

- Move to Schedule A and detail the Maryland qualified agricultural property. Provide a description that includes the property’s address, liber and folio numbers, and the number of acres. Remember to support the date of death value with a certified fair market value appraisal.

- Complete the worksheet and tax computation section. Report the values as instructed, calculating the percentage of Maryland qualified agricultural property relative to the augmented gross estate.

- Fill in all necessary calculations to determine the tentative Maryland estate tax, the amount eligible for deferral, and any interest or penalties due.

- Finally, review the Agreement to Deferred Payment section. Ensure that all interested parties sign the agreement, including their names, addresses, and interests in the property.

- Once all fields are complete, save your changes. You can then choose to download, print, or share the completed form as needed.

Complete your Form Met 1 Fillable online today to ensure a smooth application process.

Related links form

Form 1041 is used for reporting income on estate and trust returns, while Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return. Understanding the differences is vital for accurate filing. For ease, consider utilizing options that offer a Form Met 1 Fillable feature, making these forms easier to manage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.