Loading

Get Form 8752

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8752 online

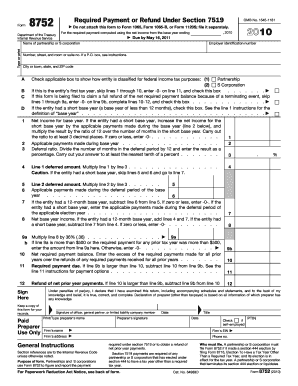

This guide provides a clear and user-friendly approach to completing Form 8752 online. Designed for partnerships and S corporations, this form assists in calculating required payments or refunds under Section 7519.

Follow the steps to complete Form 8752 online effectively

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the name of the partnership or S corporation in the designated field.

- Type or print the employer identification number (EIN) accurately.

- Fill in the address details, including number, street, city or town, state, and ZIP code.

- Select the applicable classification box indicating whether the entity is a partnership or an S corporation.

- If this is the entity’s first tax year or if claiming a refund due to terminating events, check the appropriate boxes as instructed.

- Provide the net income for the base year in line 1, ensuring to follow instructions for short base years.

- List any applicable payments made during the base year in line 2.

- Calculate the deferral ratio on line 3 based on the deferral period.

- Complete the subsequent lines based on net income and required calculations described in the instructions, ensuring accuracy.

- Sign and date the form, confirming the details provided are true and correct.

- Finally, save your changes, download, print, or share the completed form as needed.

Complete your Form 8752 online today for a seamless filing experience.

You can access tax forms from ETRADE by logging into your account and navigating to the tax center. If you find it challenging to manage your tax documents, US Legal Forms can simplify the process by providing access to various forms, including Form 8752. This ensures you have everything you need for accurate tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.