Get W3pr2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W3pr2011 Form online

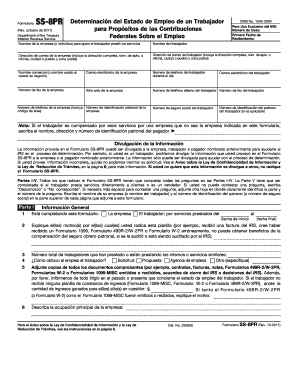

Filling out the W3pr2011 Form online is a straightforward process designed for individuals and businesses seeking to determine employment status for federal employment tax purposes. This guide will walk you through each section of the form, ensuring you understand the requirements and can complete it accurately.

Follow the steps to successfully fill out the W3pr2011 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I of the form, titled 'General Information.' Indicate whether you are completing the form on behalf of the company or the worker. Fill in the dates of service and provide an explanation for filing the form, such as receiving an IRS notice.

- Provide details such as the total number of workers who have performed similar services and how the worker obtained employment (e.g., application, agency). Attach relevant documentation, including contracts or tax forms if applicable.

- Continue to fill out Part II, which concerns the control over the worker's activities. Answer questions related to training received, the manner in which tasks are assigned, and the supervision of the worker.

- Move to Part III, which focuses on financial control. Here, detail any supplies or equipment provided by the company and describe the payment structure for the worker. Indicate any reimbursements and whether the worker incurs specific expenses related to their role.

- Complete Part IV regarding the relationship between parties. Select benefits available to the worker and indicate the nature of the employment relationship, including termination clauses.

- If applicable, fill out Part V, which addresses the responsibilities of the worker when serving clients directly or as a vendor. Answer questions about client acquisition and payment procedures.

- Once all sections are complete, ensure that you have signed and dated the form. Include the printed name of the individual who signed, along with their title if required.

- After reviewing for accuracy, save your changes. You can then download, print, or share the completed form as necessary.

Start filling out your W3pr2011 Form online now to ensure your employment status is accurately determined.

The AW 8BEN E form is a certificate that international entities use to confirm their status for U.S. tax purposes. It provides information necessary for determining tax withholding on certain types of income. By integrating the W3pr2011 Form into your filing process, you can ensure that you fulfill your tax obligations efficiently and accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.