Get Ccculv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ccculv online

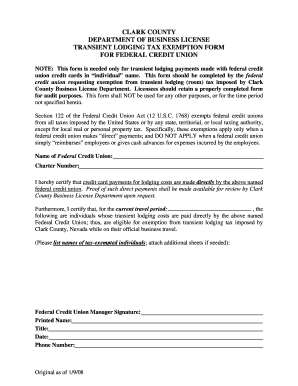

Filling out the Ccculv form online can help simplify the process of requesting a transient lodging tax exemption for federal credit union payments. This guide will provide you with step-by-step instructions to ensure your form is completed accurately and efficiently.

Follow the steps to complete the Ccculv form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the designated field, enter the name of the federal credit union requesting the exemption. Ensure that the name matches the official records of the credit union.

- Provide the charter number associated with the federal credit union in the appropriate field. This number is usually assigned by the National Credit Union Administration.

- Certify that credit card payments for lodging costs are made directly by the federal credit union. This section may require you to confirm specific details about the payment process.

- List the individuals whose transient lodging costs are directly paid by the federal credit union in the section provided. Ensure that you include the full names and consider attaching additional sheets if necessary.

- Obtain the signature of the federal credit union manager in the designated space. The printed name and title of the signer should also be provided for verification.

- Fill in the date of completion and include a contact phone number for any questions or follow-up from the Clark County Business License Department.

- After verifying that all fields are accurately filled out, you can now save changes, download, print, or share the completed form.

Start filling out your Ccculv form online to ensure a smooth tax exemption application process.

Some credit unions, including those associated with Ccculv, are known for their inclusive practices. Generally, local or smaller credit unions have a reputation for being more lenient with approvals. They may focus on community engagement and member support rather than purely on credit scores. It’s beneficial to check their specific application criteria and ask about their approval process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.