Loading

Get Irs Form 1139 Instructions

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 1139 instructions online

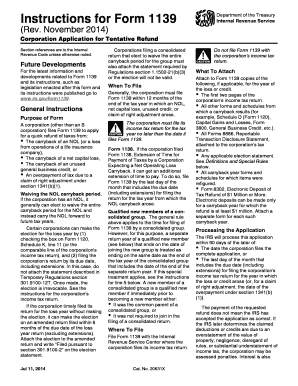

Filling out the IRS Form 1139 for corporation application of a tentative refund can seem daunting. However, with this comprehensive guide, you will receive clear instructions on how to fill out the form accurately and efficiently online.

Follow the steps to complete the IRS Form 1139 online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Fill in the corporation's name, address, and Employer Identification Number (EIN) in the designated areas of the form.

- In Line 1a, enter the amount of the net operating loss for carryback claims, ensuring to attach any required statements.

- If applicable, enter the net capital loss on Line 1b. Ensure this amount does not produce or increase an NOL.

- For Line 1c, if you are claiming an unused general business credit, attach the relevant credit form for the corresponding tax year.

- Complete Line 1d if you are applying for a refund due to an overpayment under section 1341(b)(1).

- Progress to the section that computes the decrease in tax (Lines 11 to 27). Input amounts for each applicable carryback year.

- Review all entries for accuracy to avoid material omissions or math errors that might lead to disallowance of your application.

- Once you have filled in all necessary sections and checked for accuracy, save your changes, download the completed form, and print it for your records.

- Submit the completed Form 1139 to the appropriate IRS Center where your corporation files its tax returns, not with the income tax return.

Start filling out your IRS Form 1139 online today to ensure your refund application is completed accurately and promptly.

You can obtain IRS tax forms and instructions directly from the official IRS website. It offers a comprehensive collection of all necessary forms, including Irs Form 1139 instructions. Additionally, uslegalforms provides user-friendly access to various tax forms and guidance to simplify your filing process. You can easily find and download the needed documents there.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.