Get Sf 329c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sf 329c online

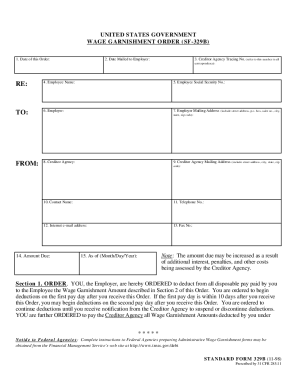

The Sf 329c is an essential component in the Administrative Wage Garnishment package and provides employers with a worksheet to calculate the appropriate amount to withhold from an employee's wages. This guide offers comprehensive, step-by-step instructions on how to fill out the Sf 329c online, ensuring users can complete the form efficiently and accurately.

Follow the steps to complete the Sf 329c online.

- Press the ‘Get Form’ button to access the Sf 329c and open it in your preferred editor.

- Begin by filling in the debtor's name and social security number at the top of the worksheet. Ensure these details accurately reflect the individual associated with the wage garnishment order.

- Indicate the pay period frequency by selecting from the options provided: weekly, every other week, two times per month, or monthly. If your frequency is not listed, specify it in the designated area.

- Proceed to calculate the debtor's disposable pay. Start by entering the gross amount paid to the employee. This includes all forms of compensation such as salary, overtime, and bonuses.

- List all allowable deductions from the gross amount under the specified categories, including federal and state taxes, health insurance premiums, and any other mandatory withholdings. Add these amounts to arrive at total allowable deductions.

- Subtract the total allowable deductions from the gross amount paid to determine the disposable pay.

- Calculating the wage garnishment amount requires checking if there are other priority withholding orders. Follow the worksheet instructions to find the applicable amounts based on the percentages indicated and any previously received orders.

- Identify the appropriate wage garnishment amount based on the provided calculations, noting the smallest amount determined in the previous steps.

- Once all information is entered and double-checked for accuracy, save the completed worksheet. You can download, print, or share the finished form as required.

Complete the Sf 329c and any related documents online for a smooth administrative process.

Filing an exemption for wage garnishment in California requires submitting a claim form to the court where your wage garnishment originated. You will need to demonstrate that the garnishment creates an undue hardship or that your income falls under certain protected categories. The SF 329c provides guidance on exemptions, ensuring you follow the correct procedures to safeguard your earnings and financial wellbeing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.