Loading

Get Form Va 4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Va 4 online

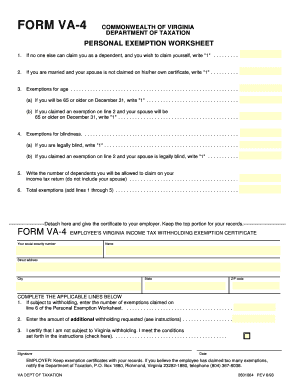

Filling out the Form Va 4 online is an essential step for individuals who wish to notify their employer about Virginia income tax withholding exemptions. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Form Va 4 online effectively.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Begin with the Personal Exemption Worksheet section. If you wish to claim yourself as a dependent, write '1' on line 1, but only if no one else can claim you.

- If you are married and your spouse cannot be claimed elsewhere, write '1' on line 2.

- For additional exemptions, refer to line 3. If you will be 65 or older by December 31, write '1' on line 3a. If your spouse will also be 65 or older, write '1' on line 3b.

- Line 4 addresses exemptions for blindness. If you are legally blind, write '1' on line 4a, and if your spouse is legally blind, write '1' on line 4b.

- On line 5, include the total number of dependents you are allowed to claim on your tax return. Do not include your spouse.

- Calculate the total exemptions on line 6 by adding the numbers from lines 1 to 5.

- Move to the Exemption Certificate section. Include your social security number, name, and address in the designated fields.

- For line 1, enter the number of exemptions claimed from line 6 of the Personal Exemption Worksheet.

- If you want additional withholding, specify the amount on line 2.

- If you believe you are not subject to Virginia withholding, check the box on line 3 and ensure you meet the specified conditions.

- Review all entries for accuracy, then save your changes, download the completed form, print it, or share it as needed.

Start completing your documents online for a smooth filing experience.

The number of exemptions you should claim on the VA-4 form is determined by your individual financial situation, including income, number of dependents, and tax obligations. It's a good idea to calculate your tax liability before making this decision to avoid under-withholding or over-withholding. UsLegalForms can support you in navigating this process by providing personalized guidance and resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.