Get Ftb 3552 - Identity Theft Affidavit - Mhaven.net

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FTB 3552 - Identity Theft Affidavit online

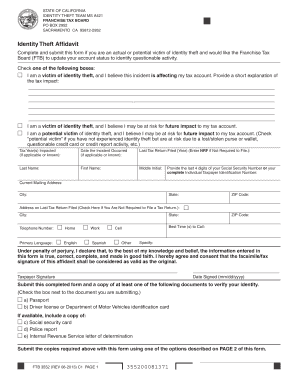

The FTB 3552 - Identity Theft Affidavit is a crucial document for users who are victims or potential victims of identity theft. This guide will provide clear, step-by-step instructions on filling out the form online, ensuring you can effectively communicate your situation to the Franchise Tax Board.

Follow the steps to complete the FTB 3552 form online.

- Click the ‘Get Form’ button to access the online version of the FTB 3552 - Identity Theft Affidavit.

- Begin by selecting the appropriate checkbox to indicate your status as a victim or potential victim of identity theft. You can choose from three options: 1) I am a victim of identity theft affecting my tax account; 2) I am a victim of identity theft at risk for future impact; or 3) I am a potential victim at risk for future impact.

- If applicable, fill in the tax years impacted by the identity theft and the date the incident occurred. Provide the year of your last tax return filed, entering 'NRF' if not required to file.

- Enter your personal details, including your last name, first name, middle initial, and the last four digits of your Social Security Number or your complete Individual Taxpayer Identification Number.

- Complete your current mailing address, including city, state, and ZIP code. If the address on your last tax return differs, fill in that address as well.

- Provide your phone number, indicating whether it is your home, work, or cell number, and select your primary language preference from the options provided.

- Specify the best times for the Tax Board to call you by indicating your available times.

- Read and agree to the declaration under penalty of perjury, then sign and date the affidavit.

- To verify your identity, check the appropriate box to indicate which document you are submitting: passport, driver license or DMV ID, Social Security card, police report, or IRS letter of determination.

- Follow the instructions for submission, either by mail or fax, as provided on the form. Ensure you include necessary documentation depending on your situation.

- After filling out the form, you can save your changes, download the document, print it for mailing, or share it as necessary.

Start completing your FTB 3552 - Identity Theft Affidavit online today to ensure your tax account is secure.

In California, identity theft includes stealing someone's personal information to commit fraud or deception. This may involve opening credit accounts, making purchases, or even filing false tax returns using your information. Understanding this definition is important, as it lays the groundwork for your legal actions. To assist you, consider the FTB 3552 - Identity Theft Affidavit - Mhaven to clarify your rights.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.