Loading

Get 21h

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 21h online

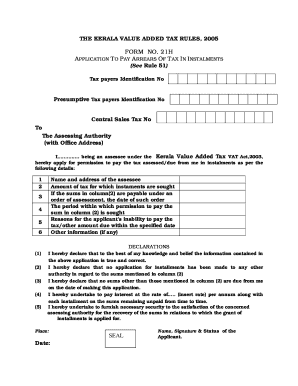

The 21h form allows users to apply for permission to pay arrears of tax in installments under the Kerala Value Added Tax Act. This guide provides a clear, step-by-step approach to filling out the form accurately and effectively.

Follow the steps to complete the 21h form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Input your taxpayer identification number in the appropriate field, ensuring it is accurate to avoid processing delays.

- For presumptive taxpayers, enter your presumptive taxpayer identification number in the designated section.

- Include your central sales tax number in the provided field to facilitate the review of your application.

- Address the form to 'The Assessing Authority' and include their office address for proper routing.

- In the section for the name and address of the assessee, clearly write your full name and address for official correspondence.

- Enter the total amount of tax for which you are seeking to pay in installments in the designated column.

- If applicable, provide the date of the assessment order, which determined the amount in column (2).

- Specify the period during which you are requesting permission to pay the tax mentioned in column (2).

- Detail the reasons for your inability to pay the specified amount on the due date, providing thorough and honest explanations.

- Include any additional relevant information that may support your application in the 'Other information' section.

- Sign and date the declaration section, ensuring all information is true and correct to the best of your knowledge.

- Indicate if you have made any other applications for installments regarding the amounts in column (2).

- Confirm that no other sums apart from those listed are owed upon making this application.

- Insert the interest rate to be paid along with the installments on the sums remaining unpaid.

- Commit to providing necessary security as required for the recovery of the sums being applied for.

- Finalize by including your name, signature, and status as the applicant, and ensure all required components are filled out.

- Once all sections are completed, save your changes, and consider downloading or printing the form for your records.

Ready to take the next step? Complete your 21h application online today!

Quando falamos sobre 21h, referimos-nos ao horário que equivale a 9 da noite. Esse horário é frequentemente utilizado em eventos sociais, reuniões e atividades que acontecem após o pôr do sol. Saber que horas são 21h ajuda você a se organizar melhor ao planejar seus compromissos. Além disso, plataformas como o US Legal Forms podem auxiliar na organização de documentos relacionados a eventos programados nesse horário.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.