Loading

Get Form H1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form H1 online

Filling out the Form H1 is a crucial step in complying with tax regulations. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete your Form H1 correctly.

- Press the ‘Get Form’ button to access the form and launch it in an editable format.

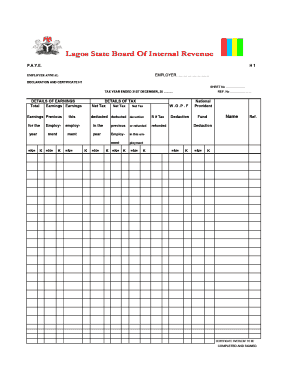

- In the employer section, enter the name of your organization. Make sure to accurately list your employer’s name as it appears on official documents.

- Fill in the Employer Annual Declaration and Certificate section, providing the sheet number and the tax year ending December 31st of the applicable year.

- In the details of tax section, input your net tax details. Double-check to ensure the figures are correctly calculated and accurately reflect your tax liabilities.

- Complete the details of earnings section by listing total earnings and previous earnings for the specified year. Ensure to break down earnings into appropriate classes as required by the form.

- For each class of emoluments detailed in the form, ensure that you enter the total amount accurately. Include any payments made after March 31st that affect the current year's tax declaration.

- Complete the sections relating to lump sum payments and pecuniary liabilities, ensuring that any reimbursements or payments made on behalf of employees are detailed accurately.

- In the officials section, enter the name of the person receiving the form and the nature of the payment being declared, making sure this corresponds to the correct tax year.

- Review the declaration section carefully, ensuring all information matches the tax deduction cards being submitted. Include a signature, designation, and date to complete the form.

- Finally, save your changes, download a copy for your records, and share the completed form with the necessary offices by the submission deadline.

Complete your Form H1 online today to ensure compliance with tax regulations.

Currently, the form I-864, which is an affidavit of support, cannot be filed online. You need to submit this form via mail after completing it. When working with related forms such as the Form H1 and I-864, consulting resources available on platforms like USLegalForms can clarify the filing requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.