Loading

Get Et 4310

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Et 4310 online

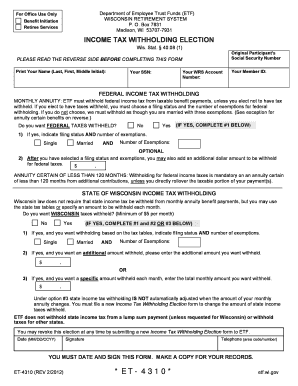

The Et 4310 form is essential for making income tax withholding elections for your retirement benefits in Wisconsin. This guide provides clear, step-by-step instructions to help users easily navigate the online form and ensure accurate completion.

Follow the steps to fill out the Et 4310 online effectively.

- Click the 'Get Form' button to access the Et 4310 form and open it in your preferred online tool.

- Begin by entering your name as it appears on your legal documents in the designated area. Make sure to include your last name, first name, and middle initial.

- Provide your Social Security number in the corresponding field to identify your application.

- Input your WRS account number and your member ID, ensuring accuracy as these are essential for processing.

- Decide if you would like federal income tax withheld from your monthly annuity payments. If you do not wish to have taxes withheld, select 'No'. If you choose to have taxes withheld, select 'Yes' and move to the next field.

- If you selected 'Yes' for federal tax withholding, indicate your filing status (either 'Single' or 'Married') and enter the number of exemptions you claim.

- If you would like to withhold an additional specific dollar amount for federal taxes, enter that amount in the provided space.

- Next, determine if you want Wisconsin state income taxes to be withheld. Select 'No' if you do not want withholding. If you select 'Yes', proceed to fill out the subsequent fields.

- For Wisconsin tax withholding, indicate your filing status and number of exemptions if you prefer withholding based on state tax tables.

- Alternatively, if you wish to specify an additional amount for Wisconsin taxes to be withheld, enter that figure in the specified area or indicate a specific amount you want withheld each month.

- Be sure to provide the date in the format MM/DD/CCYY to validate your form.

- Sign the form to certify that the information provided is accurate and complete.

- Lastly, save your changes, and choose to download, print, or share your completed Et 4310 form as needed.

Complete your Et 4310 form online today to ensure timely processing of your benefits.

To fill out Schedule L correctly using Et 4310, begin by entering your total assets in the appropriate sections, followed by liabilities and equity. Check all values to ensure that they are consistent with your accounting records. Completing Schedule L accurately is crucial for a successful submission, and USLegalForms offers templates and guidance to help you navigate this process seamlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.