Loading

Get Irs 8971 2016-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8971 online

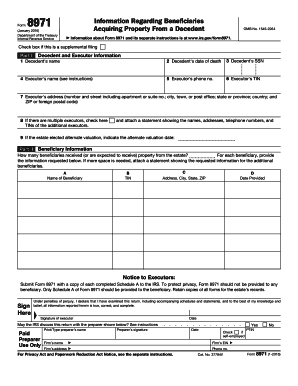

Filling out the IRS Form 8971 is essential for executors managing estates. This guide provides clear, step-by-step instructions for completing the form online, ensuring you have the necessary information at hand as you proceed with the filing process.

Follow the steps to effectively complete the IRS Form 8971 online.

- Press the ‘Get Form’ button to access the IRS 8971 form and open it in your preferred online editor.

- Begin by entering the decedent's name, date of death, and social security number in the designated fields.

- Next, provide the name, phone number, taxpayer identification number (TIN), and address of the executor in the respective sections.

- If there are multiple executors, check the appropriate box and attach a statement with the additional executors’ information.

- Indicate the alternate valuation date if the estate has elected to use alternate valuation.

- Proceed to Part II and specify the number of beneficiaries receiving property from the estate.

- For each beneficiary, fill out their name, TIN, address, and the date the information was provided.

- Review all entries for accuracy and ensure all required fields are completed properly.

- Finally, save your changes, download a copy of the completed form, and prepare to print or share it as needed.

Complete your IRS Form 8971 online today to ensure timely and accurate filing.

IRS Form 8871 is used by organizations to apply for tax-exempt status under section 501(c)(3). This form allows an organization to officially request recognition from the IRS, which can lead to many financial benefits. Filling out this form accurately is vital to securing your organization's tax-exempt status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.