Loading

Get Irs 14039-b (sp) 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14039-B (SP) online

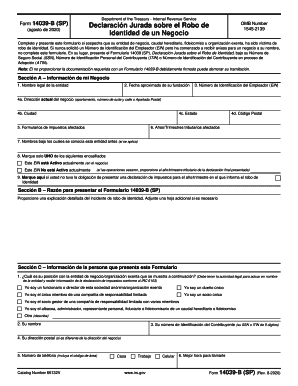

This guide provides a step-by-step approach to completing the IRS Form 14039-B (SP), a declaration for identity theft concerning a business. It aims to assist users in navigating the form accurately and efficiently while ensuring compliance with IRS requirements.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and view it in your preferred editor.

- In Section A, provide information about your business, including the legal name, date of establishment, Employer Identification Number (EIN), and current address. Be thorough in filling all fields, especially the tax forms affected and the years or quarters impacted by the identity theft.

- In Section B, offer a detailed explanation of the identity theft incident. If necessary, use an additional sheet to ensure clarity.

- In Section C, fill in your role within the business entity. Options include being an officer, owner, or trustee, and ensure that you include your name, taxpayer identification number, and your contact details.

- In Section D, provide information related to any individuals involved in misusing your EIN, if known. Attach copies of supporting documents as outlined in this section to validate your identity and the situation.

- Finally, in Section E, sign and date the form, confirming the truthfulness of the information you have provided.

- Upon completing all sections, save your changes, and download or print the form for submission. Decide if you will send it by mail or fax, or if you plan to present it in person at an IRS office.

Complete your IRS 14039-B (SP) form online today to address identity theft proactively.

You can request an IRS verification letter by submitting the necessary forms to the IRS, which may include form 14039-B (SP) if related to identity theft. You will need to provide specific details to assist with your request. The IRS will review your claim and issue a verification letter to confirm your identity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.