Loading

Get Irs 8849 Schedule 2 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8849 Schedule 2 online

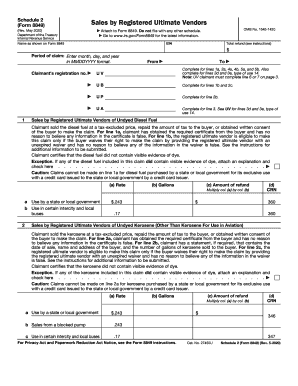

Filling out the IRS 8849 Schedule 2 is essential for registered ultimate vendors who seek refunds for certain fuel sales. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to successfully complete the IRS 8849 Schedule 2 online.

- Click the 'Get Form' button to access the IRS 8849 Schedule 2 and open it in your preferred editor.

- In the top section, enter your name as it appears on Form 8849 and your Employer Identification Number (EIN). These details are crucial for proper identification.

- Complete the 'Total refund' field by entering the total refunds you're claiming, calculated from all applicable lines, following the instructions provided.

- For the 'Period of claim', input the dates using the MMDDYYYY format to indicate the sales period for which you are filing the claim.

- Fill in the 'Claimant’s registration no.' field, ensuring you have the correct registration number obtained from the IRS.

- Complete the relevant sections based on the type of fuel sold: undyed diesel fuel, kerosene, gasoline, or aviation gasoline. Each type has specific lines to fill out, so ensure to enter details accurately.

- For government unit claims involving diesel fuel or kerosene, complete Line 6 for each government unit, including their Taxpayer Identification Number and the number of gallons sold.

- For nonprofit educational organization and governmental unit claims related to gasoline sales, fill out Line 7 similarly.

- Review the completed form for accuracy, ensuring all required fields are correctly filled out.

- Once satisfied with the accuracy, save changes, and download a copy of the completed form for your records. You may then print or share the form as needed.

Complete your IRS 8849 Schedule 2 online today and ensure your fuel sales claims are filed correctly!

Schedule 2 refers to a part of IRS Form 8849 designed for specific excise tax refund claims. It holds significance for taxpayers who need to report certain claims related to fuel taxes among others. Knowing how to navigate the IRS 8849 Schedule 2 is vital for accurate tax reporting and timely refunds. For a seamless experience, consider using UsLegalForms to assist with your filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.