Loading

Get Tax Return Disclosure Consent Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Return Disclosure Consent Forms online

Filling out the Tax Return Disclosure Consent Forms online is a straightforward process that allows you to authorize the disclosure of your tax return information. This guide will help you navigate each step with clarity and ease.

Follow the steps to complete the Tax Return Disclosure Consent Forms online.

- Click ‘Get Form’ button to access the Tax Return Disclosure Consent Forms and open them in your preferred editing tool.

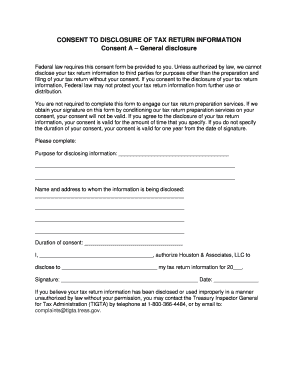

- Read through the introductory information on the form carefully. This section explains the purpose of the consent and the implications of disclosing your tax return information.

- In the section labeled 'Purpose for disclosing information,' provide a detailed explanation of why you are permitting the disclosure of your tax return information.

- Under 'Name and address to whom the information is being disclosed,' fill in the complete name and address of the individual or organization that will receive the disclosed information.

- Specify the 'Duration of consent.' This section allows you to indicate how long the consent for disclosure will be valid. If you do not specify, it will default to one year.

- In the area labeled 'I,' enter your full name, authorizing Houston & Associates, LLC to disclose your tax return information, and specify the year for which you are providing consent.

- Sign and date the form in the designated fields to finalize your consent.

- Review all the filled fields for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Start completing your Tax Return Disclosure Consent Forms online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A US tax return form is a document used to report your income, expenses, and other tax-related information to the IRS. It determines your tax liability and allows you to claim refunds or credits. Understanding the tax return process can help you prepare effectively, and utilizing Tax Return Disclosure Consent Forms can streamline communication with your tax advisor when needed.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.