Get Osceola County Generic Tourist Development Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Osceola County Generic Tourist Development Tax Return online

Completing the Osceola County Generic Tourist Development Tax Return is essential for reporting rental income and ensuring compliance with local tax regulations. This guide provides a clear, step-by-step approach to filling out the form online, making the process seamless and straightforward for all users.

Follow the steps to complete your tax return efficiently

- Click ‘Get Form’ button to obtain the Osceola County Generic Tourist Development Tax Return form and access it online.

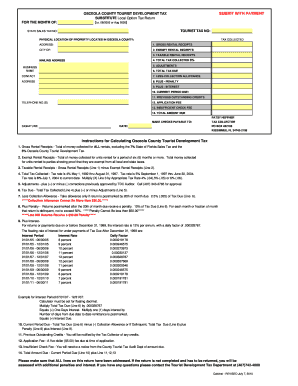

- Enter the month and year for which you are reporting by filling in the fields for 'FOR THE MONTH OF' and 'TOURIST TAX NO.' along with your 'STATE SALES TAX NO.'

- Provide the physical address for the property located in Osceola County, including the specific address and city.

- Fill in 'Gross Rental Receipts' with the total amount collected for all rentals, ensuring to exclude the state sales tax and the tourist development tax.

- Input 'Exempt Rental Receipts', which should reflect any money collected for units rented for six months or longer, or for parties with proof of tax exemption.

- Calculate 'Taxable Rental Receipts' by subtracting the exempt rental receipts from the gross rental receipts.

- Determine 'Total Tax Collected' by multiplying the taxable rental receipts by the appropriate tax rate (4%, 5%, or 6% based on the relevant period).

- List any 'Adjustments' necessary, which may include corrections approved by the Tourist Development Council Auditor, if applicable.

- Calculate 'Total Tax Due' by adding any adjustments to the total tax collected.

- Include the 'Less Collection Allowance' if the return is submitted before the 20th of the month due, noting that it cannot exceed $30.

- If applicable, add any penalties for late submissions which is 10% of the tax due, not exceeding a total of 50%.

- Include any interest due based on the specific interest periods listed in the instructions for your tax payments.

- Calculate the 'Current Period Due' by adjusting the total tax due for any collection allowances, penalties, and interest.

- Note any 'Previous Outstanding Credits' if you have received notifications from the Tax Collector.

- Include the 'Application Fee' and any 'Insufficient Check Fee', if applicable, when calculating the total amount due.

- Finally, calculate the 'Total Amount Due' by summing up the current period due and all applicable fees.

- Ensure that all sections of the form are completed thoroughly. Save changes, and then download, print, or share the form as required.

Start completing your Osceola County Generic Tourist Development Tax Return online today!

The tourist tax, often referred to as the tourist development tax in Osceola County, Florida, is charged on short-term accommodations. This tax is essential in supporting local tourism initiatives and maintaining public facilities related to tourism. It is a critical aspect of the Osceola County Generic Tourist Development Tax Return process and contributes to enhancing the visitor experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.