Get Ifta 300 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Ifta 300 Fillable Form online

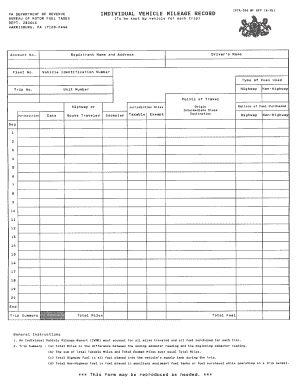

The Ifta 300 Fillable Form is a vital document for users involved in interstate commerce for reporting fuel consumption and miles driven. This guide provides clear, step-by-step instructions to ensure you can complete the form efficiently and accurately online.

Follow the steps to fill out the Ifta 300 Fillable Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the identification section, where you will need to enter your business name, address, and account number. Ensure all information is accurate and up to date.

- Proceed to the mileage section. Here, you must report the total miles driven in each jurisdiction during the reporting period. Be thorough in your calculations to avoid discrepancies.

- Next, complete the fuel section. Report the total gallons of fuel purchased and consumed in each jurisdiction, making sure to include the correct units.

- Review the section for credits, if applicable. You may need to calculate any applicable credits based on your fuel purchases and usage.

- Finally, ensure all sections are filled out correctly, review the completed form for accuracy, and make any necessary edits.

- Once satisfied with the information provided, save changes, download, print, or share the form as needed.

Complete your Ifta 300 Fillable Form online today!

IFTA stands for the International Fuel Tax Agreement, which is an agreement among the lower 48 states and Canadian provinces. This agreement simplifies fuel tax reporting for commercial vehicles traveling across multiple jurisdictions. The IFTA 300 Fillable Form is essential for reporting fuel usage and miles traveled, ensuring that you comply with each state’s requirements. By understanding IFTA, you can manage your tax obligations effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.