Loading

Get Loan Apps In Kenya Without Registration Fee

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Apps In Kenya Without Registration Fee online

This guide provides clear and concise instructions for filling out the Loan Apps In Kenya Without Registration Fee online. By following these steps, users can ensure their application is completed accurately and efficiently.

Follow the steps to fill out the Loan application form online:

- Click the ‘Get Form’ button to obtain the Loan Apps In Kenya Without Registration Fee form and open it in your preferred online editor.

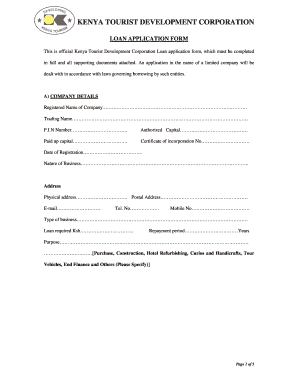

- Begin by entering the company details in section A. Provide the registered name of the company, trading name, and P.I.N number. Make sure to include authorized capital and paid-up capital along with the company's certificate of incorporation number.

- Next, fill in the date of registration, nature of business, and both physical and postal addresses. Include the email, telephone number, and mobile number associated with the company.

- Specify the type of business and the loan amount required in Ksh. Indicate the desired repayment period in years and explain the purpose of the loan, selecting from provided options or specifying if needed.

- Move to section B, where you must list the names, ID numbers, and addresses of the board of guarantors. Ensure you provide three guarantors.

- In section C, fill out the particulars of directors, one for each director of the company. Provide their name, nationality, date of birth, physical address, telephone number, mobile phone number, email, and profession.

- Proceed to section D, which details the particulars of the property to be mortgaged. Include plot number, purchase price, freehold or leasehold status, term of lease if applicable, and details about any existing mortgages.

- Indicate where the title deeds are located and in whose name they are, as well as the nearest township or municipality.

- In section E, attach all required documents, including feasibility studies and certified copies of relevant certificates. For construction cases, include approved building and structural plans, as well as NEMA approval.

- Review the terms outlined in section F regarding the obligations of the corporation and the user. Understand the implications of the fees outlined.

- Complete the directors’ declaration at the end of the application, ensuring that all directors sign and date the application.

- After fully completing the form, save changes, download or print the document as needed, and share it with the relevant parties, ensuring it is forwarded to the managing director as specified.

Start filling out your Loan Apps In Kenya Without Registration Fee online today.

With M-PESA, loan amounts vary based on your usage and repayment history, but you can typically access up to Ksh 1,000,000 through services like Fuliza. This makes it a great option among loan apps in Kenya without registration fee. Regular use and timely repayment can increase your borrowing limit, making it a flexible choice for various financial needs. Ensure you understand the repayment terms to make the most of this service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.