Get Form 451

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 451 online

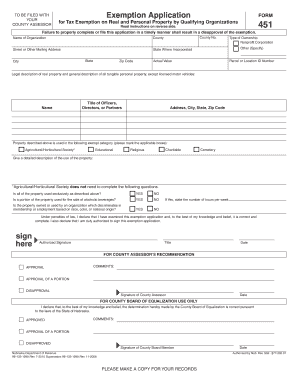

This guide provides a comprehensive overview of how to fill out Form 451 for tax exemption on real and personal property by qualifying organizations. Follow the instructions carefully to ensure your application is completed accurately and submitted on time.

Follow the steps to successfully complete Form 451.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the county number associated with your organization in the designated field.

- Input the name of your organization exactly as it is formally registered.

- Provide the street or other mailing address, including the city, state, and zip code.

- Indicate the state where your organization is incorporated.

- Fill in the parcel or location ID number for the property you are applying to exempt.

- Enter the actual value of the property as assessed for tax purposes.

- Select the type of ownership from the options provided, ensuring you choose 'Nonprofit Corporation' if applicable.

- Provide a legal description of the real property and a general description of all tangible personal property, except licensed motor vehicles.

- List the names and titles of officers, directors, or partners associated with your organization.

- Check the relevant boxes to indicate the category of exemption your property falls under, such as educational, religious, or charitable.

- In the detailed description field, explain how the property is used in relation to your selected exempt category.

- Answer the following questions regarding property use and compliance, responding 'YES' or 'NO' as applicable.

- Once completed, authenticate the form by signing in the designated area and providing your title and the date.

- After filling out the form, you can save changes, download, print, or share the completed document as needed.

Start your online exemption application process now and ensure timely submission.

To obtain Form 10IEA online, you can start by visiting reliable legal forms websites that allow you to download or fill out the form digitally. One excellent option is the Form 451 resource page, which provides access to various legal forms, including 10IEA, in an easy-to-navigate manner. This platform simplifies the process, enabling you to complete necessary forms efficiently while ensuring you have the most current versions available.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.