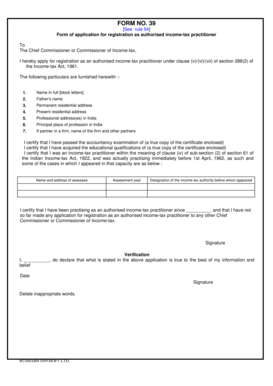

Get 39 See Rule 54 Form Of Application For Registration As Authorised Incometax Practitioner To The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 39 See Rule 54 Form of Application for Registration as Authorised Income-tax Practitioner online

Filling out the 39 See Rule 54 Form for registration as an authorised income-tax practitioner can be straightforward when you follow the necessary steps. This guide will assist you in accurately completing the form online, ensuring that you present the required information effectively.

Follow the steps to complete the application form successfully.

- Click the ‘Get Form’ button to access the form and open it in the appropriate online platform.

- Begin by filling in your full name in block letters in the designated field. Ensure it matches the name on your identification documents.

- Provide your father's name in the specified section, following the same naming conventions.

- Enter your permanent residential address. This should be the address you are registered at and can be verified if necessary.

- Fill in your present residential address. Ensure this is up-to-date to avoid any correspondence issues.

- List your professional address(es) in India. Include all relevant locations where you conduct your professional practice.

- Specify your principal place of profession in India, providing the most relevant address for your income-tax practice.

- If you are a partner in a firm, clearly state the name of the firm and list any other partners involved.

- Certify that you have passed the required accountancy examination by stating it here and ensure to enclose a true copy of your certificate.

- Indicate your educational qualifications and provide a true copy of the certificate to support your claim.

- Confirm your previous practice as an income-tax practitioner under the relevant Indian law, detailing your experience and the specific cases you handled.

- State the date when you began practising as an authorised income-tax practitioner and confirm that you have not applied for registration with another authority.

- Provide your signature in the designated field to validate the information.

- In the verification section, declare the truthfulness of your application by entering your name and signing again.

- Finally, review all filled information, make any necessary adjustments, and then proceed to save your changes. You can also download, print, or share the completed form as needed.

Complete your application form online today to become an authorised income-tax practitioner.

Those who provide tax-related services or advice are required to register as a tax practitioner. This typically includes individuals who prepare, submit tax returns, or offer tax advice. Compliance with the 39 See Rule 54 Form Of Application For Registration As Authorised Incometax Practitioner To The ensures that practitioners meet legal standards. Thus, anyone engaging in these activities should consider registration.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.