Get Mt Protest Form - Flathead County 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT Protest Form - Flathead County online

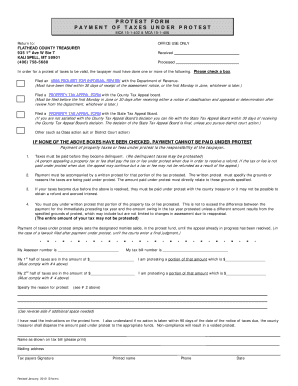

Filling out the MT Protest Form is an essential step for those wishing to protest property taxes in Flathead County. This guide provides a detailed, step-by-step approach to completing the form online, ensuring you follow the necessary procedures accurately.

Follow the steps to complete your MT Protest Form online.

- Press the ‘Get Form’ button to access the MT Protest Form. This allows you to retrieve the document and begin filling it out in your preferred editor.

- Review the initial instructions to ensure you understand the conditions under which your protest is valid. You need to confirm that you have filled out one of the required forms related to your tax assessment.

- In the section labeled 'My Assessor number', input your specific assessor number accurately to identify your property.

- Next, enter your tax bill number in the designated field to ensure that your payment is correctly matched with your account.

- Complete the sections for the first and second halves of your property taxes. For each, specify the total amount owed and the portion you are protesting. Ensure compliance with the guideline that the amount protested relates directly to your specified grounds.

- In the 'Specify the reason for protest' section, clearly outline the grounds for your protest. This is crucial for supporting your case and must be detailed according to the form's instructions.

- Read all instructions thoroughly at the end of the form regarding compliance and the implications of inaction. Acknowledge your understanding by signing and providing the necessary personal information, including your printed name, mailing address, phone number, and date.

- Once all fields are completed, save your changes. You can then download and print your completed MT Protest Form or share it as needed.

Accurately fill out and submit your MT Protest Form online today to ensure your protest is properly registered.

You can calculate Montana property tax by multiplying the assessed value of your property by the local tax rate. This calculation provides a clear indication of your tax liability. Property assessments are typically reviewed every year, so be sure to stay updated. For assistance in understanding these calculations, you may refer to resources like the MT Protest Form - Flathead County.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.