Loading

Get Sa1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa1 Form online

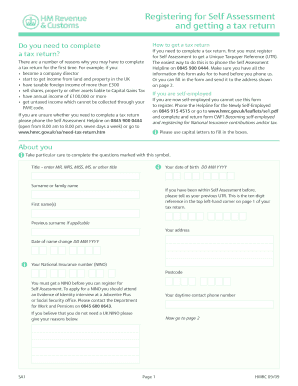

Filling out the Sa1 Form online is an essential step for individuals who need to register for Self Assessment and complete their tax returns. This guide provides clear, step-by-step instructions to navigate the form efficiently and successfully.

Follow the steps to complete the Sa1 Form.

- Click the ‘Get Form’ button to obtain the Sa1 Form and open it in the editor.

- Begin by providing your personal information. Fill out the boxes with your title, date of birth, surname, first name(s), and any previous surname if applicable. Ensure every section marked with a symbol is filled accurately.

- Next, provide your address, National Insurance number (NINO), postcode, and daytime contact phone number. If you do not have a UK NINO, please include your reasoning in the designated area.

- In the section titled 'Why do you need to complete a tax return?', select the appropriate reasons by ticking the boxes and entering the relevant dates. Ensure you complete this section fully, marking any pertinent reasons that apply to you.

- Finally, you must sign and date the declaration at the bottom of the form. Confirm that the information provided is correct to the best of your knowledge.

- Once all sections are completed, review your entries for accuracy. Save your changes, download a copy for your records, print the form if necessary, and share it as instructed.

Complete your Sa1 Form online today to ensure a smooth registration process for Self Assessment.

Individuals who earn income not taxed at source, such as freelancers, landlords, or those with other untaxed earnings, need to file a self-assessment form. The Sa1 Form is the first step for many in this process. If you find yourself in this category, timely filing is crucial to avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.