Loading

Get 941 C

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 941 C online

Completing the 941 C form online is an essential task for users needing to make adjustments to employment tax information. This guide provides clear and supportive instructions to help you navigate the process effectively.

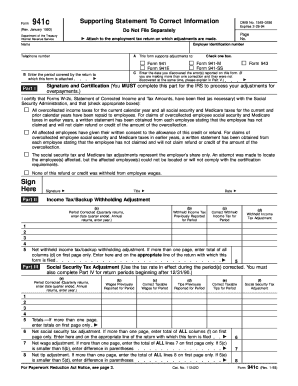

Follow the steps to complete the 941 C form online.

- Click ‘Get Form’ button to access the 941 C form and open it in the editor.

- Begin by filling in the name, employer identification number, and telephone number in the designated fields.

- In section A, check the box corresponding to the type of return this form is supporting, such as Form 941 or Form 943.

- For section B, enter the period covered by the return associated with this form.

- In section C, provide the date on which you discovered the errors that you are correcting.

- Proceed to Part I to complete the Signature and Certification section, ensuring you check the appropriate boxes based on your situation regarding overcollected taxes.

- Move on to Part II to adjust income tax and backup withholding by filling in the previously reported amounts and any necessary corrections.

- Continue to Part III and insert the corrections for social security taxes, ensuring to fill all required columns for each return period.

- Complete Part IV by adjusting Medicare tax information as needed, following the same protocol for submitting corrections.

- Finally, provide an explanation of the adjustments in Part V and review all entries for accuracy. You can then save changes, download, print, or share the completed form.

Start filling out your 941 C online and ensure your employment tax records are accurate.

Purpose of form. Use Form 941c to provide background information and certifications supporting prior period adjustments to income, social security, and Medicare taxes reported on Form 941, 941-M, 941-SS, 943, 944, 944(SP), 944-SS, or Form 945.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.