Get Fincen Form 114a 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FinCen Form 114a online

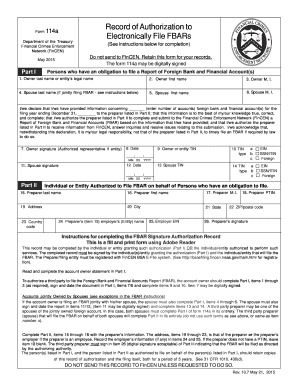

Filling out the FinCen Form 114a is a necessary step for individuals who wish to authorize a third party to file a Report of Foreign Bank and Financial Accounts (FBAR) on their behalf. This guide provides clear, step-by-step instructions on completing this form online, ensuring that users from all backgrounds can navigate the process with ease.

Follow the steps to fill out the FinCen Form 114a online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Proceed to fill in Part I of the form. Start by entering the owner’s last name or entity's legal name in the appropriate field, followed by their first name and middle initial. If filing jointly with a spouse, include their last name, first name, and middle initial.

- In the declaration section, indicate the number of foreign bank and financial accounts for the specified filing year. Ensure that the information you provide is accurate to the best of your knowledge.

- Complete the signature section by signing and dating the form where indicated. If applicable, include the TIN (Tax Identification Number) for both the owner and spouse, selecting the appropriate TIN type from the provided options.

- Move on to Part II of the form, where you will provide the authorized preparer’s information. Fill in the preparer's last name, first name, middle initial, and other required details such as address and preparer's employer name and EIN.

- Ensure that the preparer signs and dates the form in the designated area. Remember that digital signatures are acceptable for both the owner and the preparer.

- After completing all sections of the form, review your entries for accuracy. Finally, save your changes, download the form, or print it for your records as needed.

Complete your FinCen Form 114a online today to ensure proper authorization for filing your FBAR.

Related links form

Individuals and entities with foreign bank accounts that meet or exceed $10,000 in total value are required to file the FinCEN Form 114. This includes U.S. citizens, residents, and certain businesses. Failing to file correctly can result in significant penalties, so it is essential to ensure you meet these requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.